- Chainlink’s noncirculating supply deposits to Binance correlate with LINK price surges, indicating a strategic market influence.

- Notable LINK transactions coincide with price fluctuations, emphasising the impact of large transfers on LINK’s value.

- The latest 8.2 million LINK deposit marks a significant event in LINK’s market presence, contributing to its upward trend.

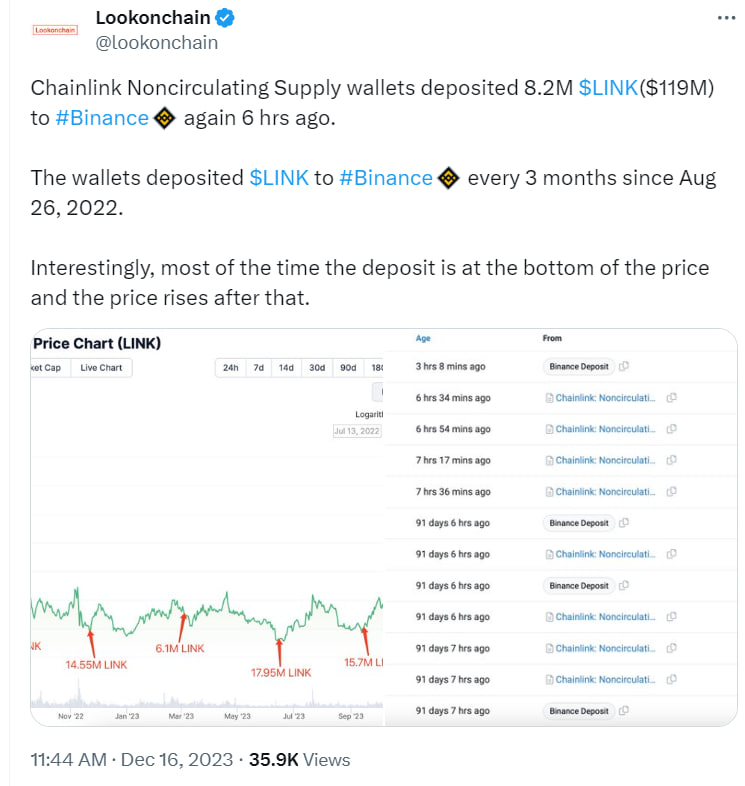

Chainlink’s noncirculating supply wallets have stirred the market in a remarkable pattern. Every three months since August 2022, these wallets have deposited significant LINK amounts to Binance. Lookonchain, a notable analytics platform, highlighted this intriguing trend via a tweet on the X platform. Consequently, the LINK price often rises after these deposits.

Significantly, a recent deposit of 8.2 million LINK, valued at approximately $119 million, occurred recently. This pattern precedes a price surge consistently. Moreover, the data suggests a strategic timing for these deposits, often aligning with price bottoms. Hence, these movements signal key market shifts.

Lookonchain’s detailed analysis of LINK’s price history revealed a volatile journey. Various peaks and troughs, marked by red arrows, align with notable LINK volumes. For instance, as per the chart provided by Lookonchain, a 17.5 million LINK transaction coincided with a price dip in September 2022. Similarly, November 2022 saw a 14.55 million LINK move. Each transaction has a distinct impact on LINK’s price trajectory.

Furthermore, the volume histogram alongside the price graph provides additional insight into this trend. Surges in trading volume frequently align with notable price fluctuations. To illustrate, in January 2023, a transaction involving 6.1 million LINK tokens took place at relatively lower prices. In contrast, during May 2023, there was a substantial increase in LINK’s price, coinciding with a transaction involving 17.95 million LINK tokens. Importantly, it should be noted that a movement of 15.7 million LINK tokens preceded a decline in price in July 2023.

However, the latest data point, an 8.2 million LINK transaction, marks the chart’s highest peak. This suggests a crucial event or transaction influencing LINK’s market presence. The overall upward trend, especially towards December 2023, is evident.

Chainlink’s current price is $14.80, reflecting a 4.44% increase over the last 24 hours. This pattern underscores the dynamic and influential nature of Chainlink’s market activities. As Chainlink continues to navigate the crypto landscape, its strategic transactions remain a key area of interest for market analysts and investors alike.