- Chase Bank UK bans crypto payments due to rising fraud concerns, starting October 16.

- Customers urged to seek crypto-friendly banks, but UK options remain limited.

- FCA mediates talks between traditional banks and crypto firms amid industry reluctance.

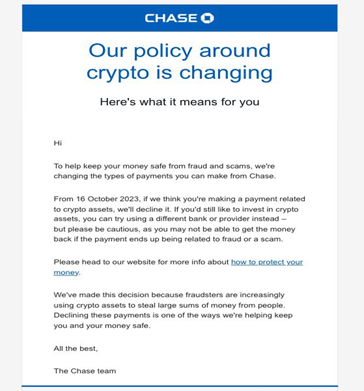

In a recent development, JP Morgan’s Chase Bank, a global banking heavyweight, has notified its U.K. customers that it will enforce a ban on transactions related to cryptocurrencies using debit cards or outgoing bank transfers. This policy will come into effect from October 16, as per an email communication sent to customers.

The email explicitly stated that the bank would decline a transaction if it is identified related to crypto assets. The bank also informed customers that they are at liberty to explore other banking institutions or service providers if they intend to venture into cryptocurrency investments. Nevertheless, the email acknowledged the scarcity of crypto-friendly banks in the U.K., citing the historical tendency of U.K. banks and credit institutions to impose restrictions on crypto-related transactions.

The driving force behind Chase U.K.’s decision lies in the rising threat of cryptocurrency-related scams that have been targeting users in the United Kingdom. Chase cited concerns about fraudsters exploiting cryptocurrencies as a means to defraud individuals, a justification echoed by other U.K. banks that have previously imposed similar restrictions.

Chase U.K.’s spokesperson emphasized the bank’s unwavering commitment to safeguarding its customers’ funds, stating,

We’re committed to helping keep our customers’ money safe and secure. We’ve seen an increase in the number of crypto scams targeting U.K. consumers, so we have taken the decision to prevent the purchase of crypto assets on a Chase debit card or by transferring money to a crypto site from a Chase account.

The Financial Conduct Authority (FCA), the regulatory body overseeing the financial sector in the U.K., recently revealed that it has been instrumental in facilitating discussions between traditional banks and cryptocurrency firms. This intervention was prompted by the reluctance of lenders to provide services to the cryptocurrency industry, underscoring the ongoing challenges faced by cryptocurrency enthusiasts and businesses in the country.

Recently, Action Fraud, the U.K.’s national reporting centre for fraud and cybercrime, disclosed that losses resulting from cryptocurrency fraud surged by a staggering 40% over the past year. These losses surpassed £300 million for the first time, reinforcing the urgent need to address cryptocurrency-related scams and fraudulent activities.

The Financial Conduct Authority (FCA) in the United Kingdom has been inspecting illegal cryptocurrency ATMs located in East London. The FCA has initiated this as a joint operation with the Metropolitan Police to exercise its enforcement powers.