- The SEC’s dismissal of Coinbase’s 18-month plea for crypto regulations triggers legal action, with CLO Paul Grewal committed to pursuing an appeal.

- Coinbase’s CLO reaffirms defiance and aims to contest SEC’s denial in Third Circuit filing.

- The crypto sector’s enduring battle against SEC denials illustrates its ongoing challenge in shaping comprehensive US regulatory frameworks.

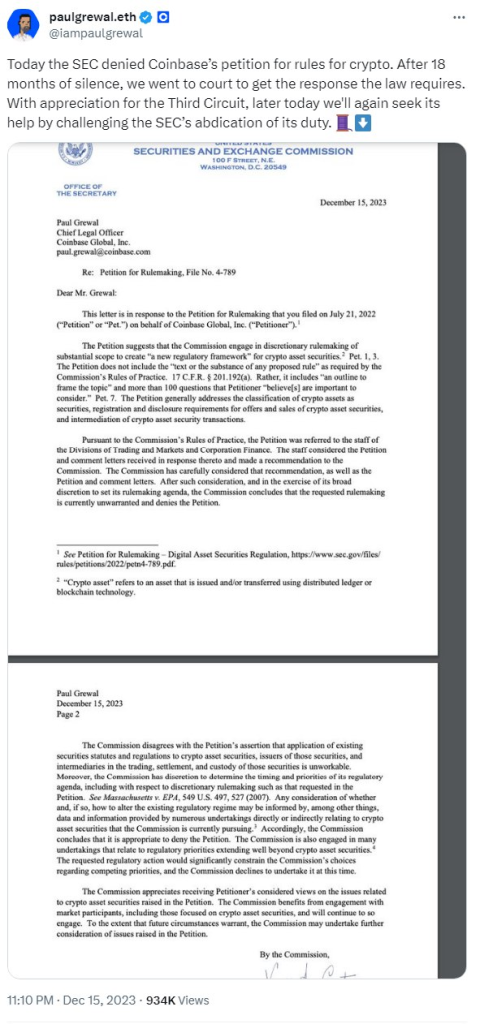

In a pivotal move, Coinbase Global Inc., a prominent cryptocurrency exchange, faced a setback in pursuing crypto-specific regulations from the United States Securities and Exchange Commission (SEC). The rejection came after an 18-month wait when the SEC officially denied its request. However, rather than conceding defeat, the platform’s Chief Legal Officer (CLO), Paul Grewal, affirmed their intention to challenge the decision through an appeal.

Grewal expressed discontent with the SEC’s reaction in the X post, emphasizing the regulator’s unexpected refusal following prolonged silence as a major letdown. Faced with a lack of communication, Coinbase resorted to pursuing legal measures against the regulatory entity.

In a recent X post, Paul Grewal reiterated their commitment to contest the SEC’s denial, stating, “Promise made, promise kept.” Grewal emphasized their filing with the Third Circuit to challenge what they perceive as the SEC’s “arbitrary and capricious denial” of their petition seeking crypto rulemaking.

The cryptocurrency industry in the United States has long been advocating for specific regulatory frameworks, with the SEC being a crucial player in this pursuit. However, the regulator’s reluctance has resulted in industry players facing strict enforcement-centric regulations. In their legal filing, Coinbase has accused the SEC of abusing discretion and violating the Administrative Procedure Act.

The SEC has refrained from issuing any statements or comments concerning the legal actions taken by Coinbase. Earlier in the year, the SEC launched legal actions against Coinbase, accusing the platform of selling unregistered securities and operating an unregistered securities exchange. SEC Chair Gary Gensler underscored the importance of securities laws crafted by Congress to oversee diverse investment forms, regardless of their denominations or structures.

Coinbase’s decision to contest the SEC’s denial indicates a continuous struggle within the crypto sector to establish comprehensive regulatory guidelines in the United States. This ongoing endeavor has been met with regulatory obstacles and legal confrontations, underscoring the industry’s persistent efforts to seek clarity and legitimacy within the evolving financial landscape.