- CoinShares revealed a total crypto outflow of $6.5 million, with North America taking a 90% hit.

- Ethereum shines with $6.6M inflow amid Bitcoin’s downturn; XRP gains steady traction.

- Investor interest spikes in altcoins Solana, Uniswap, and Polygon, says CoinShares.

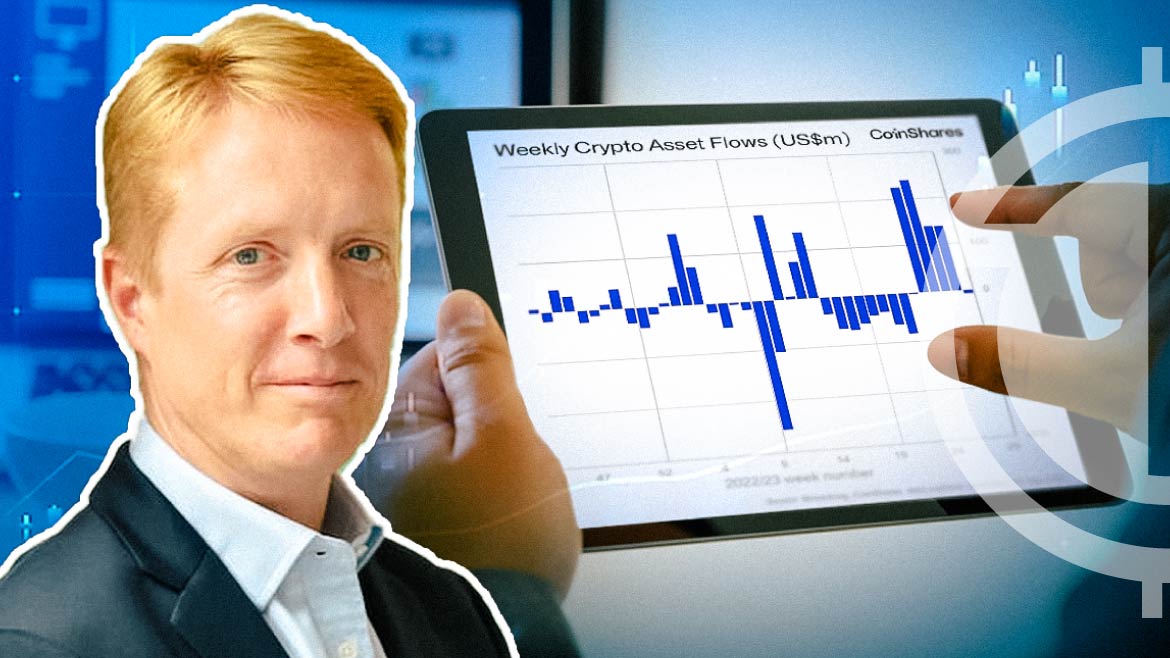

CoinShares, a prominent alternative asset manager focusing on digital assets, recently published its weekly report, providing valuable insights into the state of the digital asset investment market. According to the report, last week saw minor outflows of US$6.5 million, contrasting the previous four weeks, which witnessed substantial inflows totaling a remarkable US$742 million. Moreover, trading volumes for the week fell below the yearly weekly average, recording US$1.2 billion compared to the previous week’s US$2.4 billion.

🔎 Let’s have a look at last week’s fund flows with CoinShare’s Head of Research James Butterfill.

— CoinShares (@CoinSharesCo) July 24, 2023

⬅️ Digital asset investment products saw minor outflows totalling US$6.5m, following 4 prior weeks of inflows that totalled US$742m.

🧵1/5 pic.twitter.com/I32OtNbGV5

The report indicated that the negative sentiment predominantly affected the North American market, which experienced a considerable 99% of the total outflows amounting to US$21 million. However, this trend was partially offset by Switzerland and Germany, which saw inflows of US$12 million and US$1.9 million, respectively, showcasing varied investment preferences among different regions.

The spotlight was again on Bitcoin, as it faced outflows totaling US$13 million during the week. Concurrently, short bitcoin investment products continued to experience outflows for the 13th consecutive week, reaching US$5.5 million. CoinShares’ report also revealed a significant drop in short bitcoin’s total assets under management (AuM) from its peak of 1.3% of total bitcoin investment products to just 0.4% – the lowest level recorded since June 2022. These developments suggest a shift in investor sentiment and risk appetite concerning bitcoin-related investments.

However, amidst Bitcoin’s performance, Ethereum brought a glimmer of hope, leading the pack with inflows totaling US$6.6 million. This surge in interest suggests that investor sentiment towards Ethereum, which had experienced a lackluster year, is gradually turning around.

Another cryptocurrency that drew attention was XRP, which saw steady inflows of US$6.8 million over the past 11 weeks, constituting 8% of AuM. The consistent inflows indicate growing investor confidence in the outlook for XRP, particularly following the conclusion of the recent SEC lawsuit that had cast uncertainty over the cryptocurrency.

Beyond the major cryptocurrencies, Coinshares’ report also highlighted the increasing interest in alternative digital assets. Solana, Uniswap, and Polygon witnessed inflows totaling US$1.1 million, US$0.7 million, and US$0.7 million, respectively. This diversification of investments suggests that investors are exploring opportunities beyond well-established cryptocurrencies.