- Dr. Laffer sees Bitcoin as akin to gold, enabling monetary expansion despite its finite supply and challenging deflationary concerns.

- Laffer highlights financial systems’ adaptability, suggesting Bitcoin can evolve to meet global liquidity needs through innovation.

- Emphasizing privacy, Dr. Laffer values Bitcoin’s anonymity as a defense against government overreach.

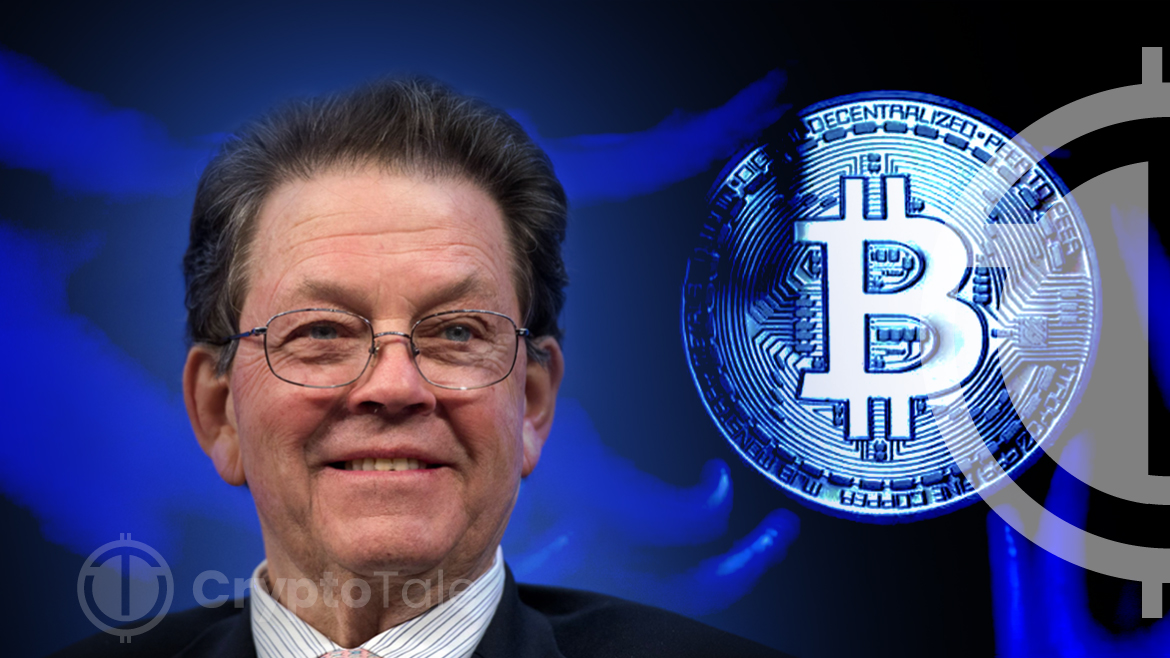

In a thought-provoking dialogue rooted in economic theory, Dr. Arthur Laffer, a luminary in the realm of economics and a pivotal figure on President Reagan’s Economic Policy Advisory Board, recently shared his insights on the potential of Bitcoin as a foundational element in the monetary system. His perspectives, rooted in the principles of supply-side economics—a doctrine often associated with his academic and policy contributions—offer a fresh lens through which to view the digital currency’s role in global finance.

Dr. Laffer’s discussion opens up a broader conversation on the feasibility of integrating Bitcoin into the economic infrastructure, akin to the historical role of gold. His analysis delves into the nuanced dynamics of deflation, a concept often linked to the finite nature of Bitcoin and its implications on global economic growth. Contrary to the conventional concerns associated with a capped currency supply, Dr. Laffer suggests that the economic framework can indeed accommodate Bitcoin as a monetary base.

The debate around deflation and Bitcoin, which is trading at $43,441.91 today, is multifaceted, with critics pointing to the risks associated with a limited supply currency. However, Dr. Laffer challenges this viewpoint by highlighting the potential for monetary expansion through banking systems and financial instruments that can adapt to the underlying value of Bitcoin. He posits that just as the gold standard allowed for financial innovation and expansion, a Bitcoin-based system could similarly evolve to meet the liquidity needs of a dynamic global economy.

Dr. Laffer further elaborates on the capacity for financial innovation to mitigate potential issues related to Bitcoin’s fixed supply. Drawing from his research, he illustrates how trade credit and other financial mechanisms have historically facilitated the balance between income and expenditure flows. This perspective underscores the adaptability of financial systems to foundational changes in monetary bases. It suggests a path forward for Bitcoin’s integration into mainstream economic structures.

An intriguing aspect of Dr. Laffer’s discourse is the emphasis on the value of anonymity within the Bitcoin network. While acknowledging the potential misuse by nefarious actors, he champions the privacy features inherent in Bitcoin as a safeguard against governmental overreach.

The discussion extends into the realm of cryptography, where Dr. Laffer references advanced encryption techniques as a means to secure transactions and protect individual liberties. He also highlighted the dual facets of technology as both a tool for privacy and a challenge to regulatory oversight.