- Over $1 billion in total inflows flooded the crypto market during a 7-week streak, marking the third-highest yearly inflow ever recorded.

- Bitcoin-backed products saw a massive $240 million influx, constituting 82% of total investments, driving YTD to $1.08 billion.

- Ethereum stole the spotlight with a remarkable $49 million inflow, a 172% increase, showcasing growing investor confidence.

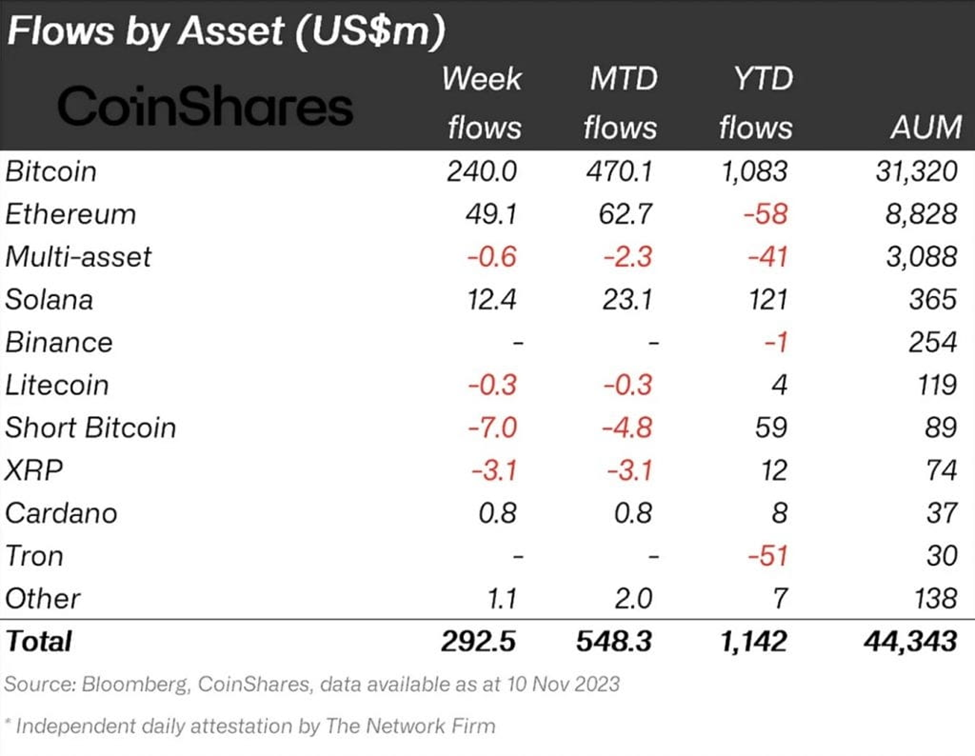

In a remarkable surge, the cryptocurrency market witnessed a staggering $1 billion in inflows during its seventh consecutive week of growth, fueled by a robust uptick in digital asset investments. The week’s influx of $293 million propelled the year-to-date (YTD) total to $1.14 billion, marking the third-highest yearly inflow ever recorded, according to a report from digital asset investment firm CoinShares.

The crypto market’s recent price surge, particularly notable in Ethereum, which saw its highest weekly inflows since August 2022, contributed significantly to this sustained growth. CoinShares reported a 9.6% rise in total assets under management (AuM) over the last week and an impressive 99% increase since the beginning of the year, bringing the total AuM for crypto-related investment products to over $40 billion.

The surge in Bitcoin-backed investment products was particularly noteworthy, with inflows reaching $240 million, constituting 82% of the total inflows for the period. This surge propelled Bitcoin’s YTD inflows to $1.08 billion, marking a substantial 19% increase from the previous week. CoinShares also highlighted the unprecedented participation of ETP investors in the rally, accounting for 19.5% of overall BTC trading volumes on reputable exchanges.

Notably, the report delves into regional contributions to this crypto investment surge, with Canada, the United States, Germany, and Switzerland leading the pack with inflows of $106 million, $81 million, $53 million, and $50 million, respectively.

Ethereum continued to shine, recording an impressive $49 million in inflows, a staggering 172% increase from the previous week and the highest since August 2022. This reaffirms Ethereum’s resilience and growing appeal among investors. Despite the overall positive momentum, short-Bitcoin products experienced outflows of $7 million, resulting in a month-to-date net flow deficit of $4.8 million.

The CoinShares report provides a comprehensive overview of the crypto market’s dynamic landscape, showcasing not only the remarkable growth in investments but also the shifting preferences and participation patterns of investors. As the market continues to evolve, these insights offer valuable perspectives for those navigating the crypto investment landscape.

In conclusion, the crypto market’s resilience and substantial inflows underscore its growing significance as a mainstream investment avenue, setting the stage for further exploration and potential developments in the weeks to come.