- Sun’s revelation of high listing fees on CEXs spotlights major barriers for crypto projects.

- Simon Dedic slams Binance’s high listing fees, saying they limit growth for smaller projects.

- Calls for fairer fees rise as the crypto community debates costly exchange listings.

Justin Sun, the founder of the Tron Network, has revealed the high costs and barriers brought about by listing tokens on top exchange platforms like Coinbase. His revelations highlight the financial issues that crypto projects face and open conversation around the industry’s entry-level limits.

In an X post on October 31, Simon Dedic, the CEO of Moonrock Capital, criticized the listing fees that Binance has set. Dedic argues that even a financially strong project, with funding over nine figures, faces steep demands. Such projects are often required to allocate 15% of their total token supply to secure a listing on Binance.

Dedic argued that these high fees make it hard for projects to succeed and often lead to falling token prices. He observed that many small-scale projects are unable to afford these fees, which prevents them from reaching their target users and driving adoption.

UK Probes TikTok Over Unlicensed Crypto Exchange AllegationsArmstrong Defends Coinbase

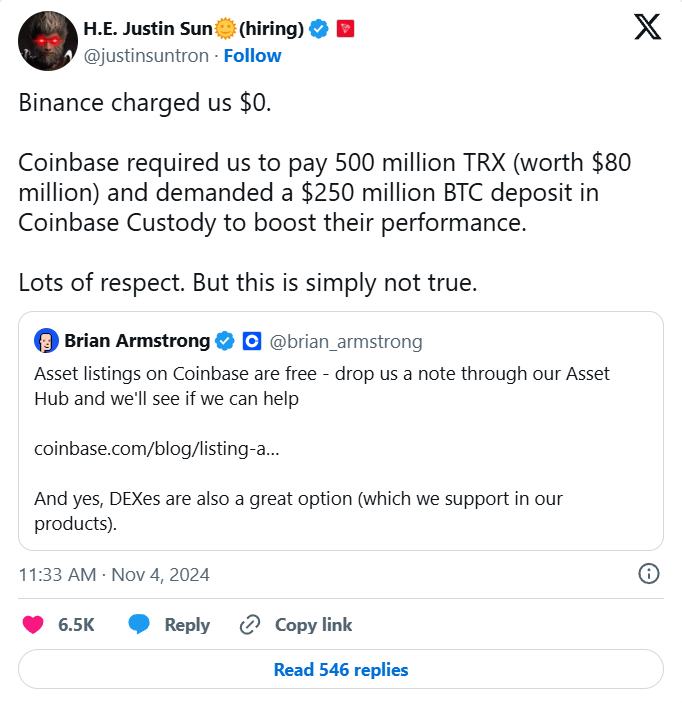

Brian Armstrong, Chief Executive Officer of Coinbase, came in defense of the criticism by explaining that Coinbase does not charge fees for project listing. Armstrong urged all the crypto projects to consider Coinbase as a potential option for their listing. He also stated that “DEXes are also a great option (which we support in our products).”

Asset listings on Coinbase are free – drop us a note through our Asset Hub and we'll see if we can helphttps://t.co/Weoa8MhLeq

— Brian Armstrong (@brian_armstrong) November 2, 2024

And yes, DEXes are also a great option (which we support in our products). https://t.co/cjp0Avu4uC

However, Justin Sun disagreed with Armstrong’s statement, sharing details of Tron’s costly listing on Coinbase. In an X post on Monday, Sun revealed that the listing cost Tron 500 million TRX, pegged at $80 million. For Coinbase to list the token, Tron had to make a $250 million BTC deposit in Coinbase Custody. Sun clarified that, in contrast, Binance did not charge Tron any fees to list its token.

Barrier for Small Projects

Andre Cronje of Sonic Labs pointed out that Binance sometimes provides free listings, while Coinbase has demanded between $60 and $300 million from other projects earlier. According to Cronje, the high fees charged on these platforms mean that only big projects are posted, making it difficult for smaller ones to gain ground.

The matter relating to listing fees is still up for debate and appears to be being hotly discussed within the community at the moment. The crypto community seems to expect the endorsement of transparency and the rationalization of fees in listed prices. Supporters believe that reversing these costs could allow more people to use crypto. This same shift would also give new projects a reasonable opportunity to thrive in the industry.