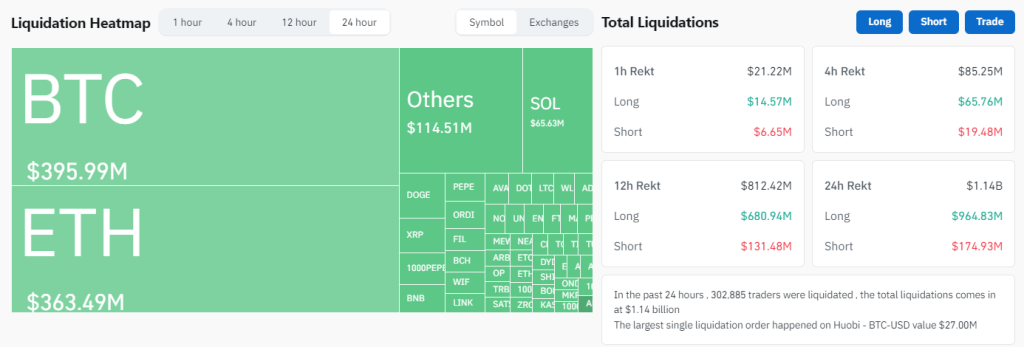

- Crypto markets saw over $1.14B in futures liquidations as Bitcoin and Ether prices nosedived.

- Ether futures faced $363.49M in liquidations, marking the worst single-day drop since May 2021.

- Over 200,000 traders liquidated amid market sell-off, with largest single order worth $27M on Huobi.

Crypto markets witnessed a severe sell-off on Sunday, resulting in over $1.14 billion in liquidations of crypto-tracked futures. This sharp decline was accompanied by a significant drop in Bitcoin and Ether prices, with Ether experiencing its worst single-day fall since May 2021. The crypto fear and greed index turned to “fear,” reflecting the market’s heightened anxiety.

In the past 24 hours, the crypto market saw a dramatic liquidation of futures. Ether futures recorded $304 million in liquidations, surpassing Bitcoin. Solana, Dogecoin, XRP, and Pepe futures collectively faced $75 million in liquidations. More than 200,000 traders were liquidated, with the largest single liquidation order worth $27 million on Huobi.

Bitcoin prices plummeted by over 11%, while Ether plunged by as much as 25% before a slight recovery. According to data, this drop marks Ether’s worst single-day price fall since May 2021. The crypto fear and greed index, which tracks market sentiment, indicated “fear” for the first time since early July.

Liquidations occur when an exchange forcefully closes a trader’s leveraged position due to insufficient funds to maintain the trade. This event significantly impacted long traders, who constituted 87% of the liquidated positions. The mass liquidations were triggered by a stronger Japanese yen and rumors of market maker Jump Trading liquidating its crypto business.

Ethereum’s Downtrend Mirrors Bitcoin’s 2020 Rise: An AnalysisGeopolitical tensions in the Middle East and disappointing earnings reports from technology firms contributed to the market downturn. These factors dampened investor enthusiasm for artificial intelligence (AI) and led to a shift away from risky assets. The situation worsened early Monday as the yen surged to a seven-month high, driven by expectations of further rate hikes by the Bank of Japan.

The surge in the yen also resulted in the unwinding of carry trades, where investors borrow in low-interest currencies to invest in higher-yielding assets. This development caused Tokyo’s Topix 100 index to suffer its biggest drop since 2011, further affecting global markets.

As a result, the crypto market faced a significant sell-off, with Ether futures experiencing unprecedented liquidations. The overall market sentiment turned negative, with the fear and greed index reflecting a sense of fear among investors. This volatile period highlights the fragile nature of the crypto market and its susceptibility to broader economic and geopolitical factors.