- Bitcoin remains under $68K, market cap grows to $2.76T, indicating varied performance across major cryptos.

- Solana rises by 9% as mixed trends dominate the crypto market, with overall capitalization increasing to $2.76 trillion.

- Despite Bitcoin’s minor dip, market sentiment hits ‘Extreme Greed’ with top altcoins like LeisureMeta seeing significant gains.

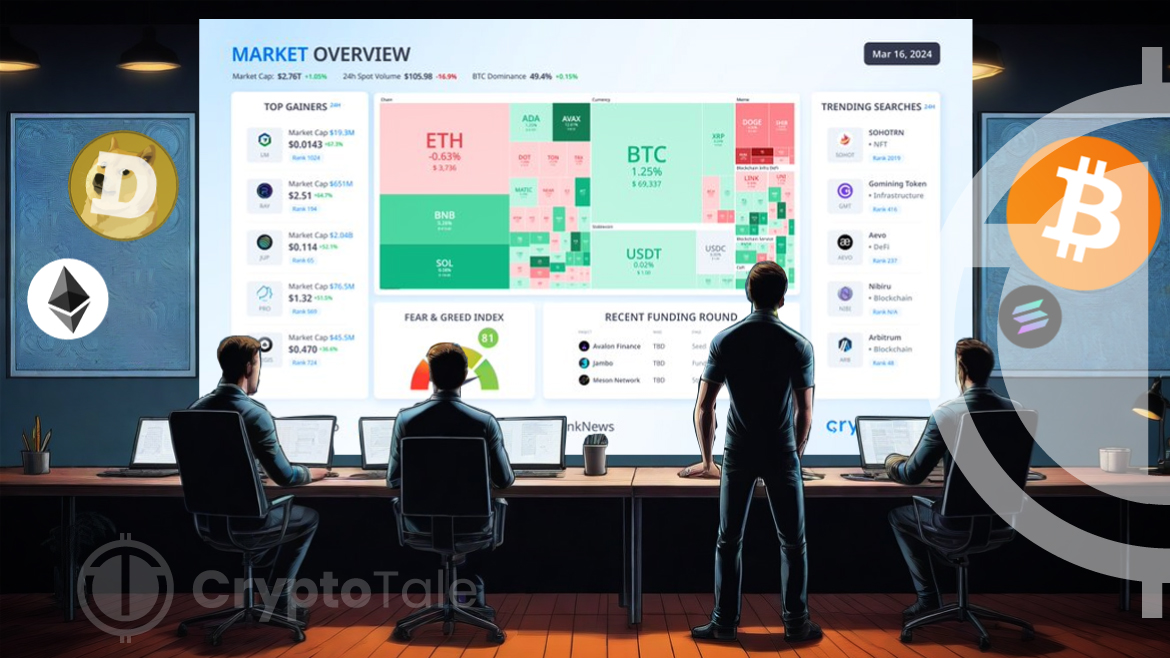

According to CryptoRank’s analysis, the market has presented a mixed bag of results with Bitcoin hovering below the $68,000 mark. This subtle yet significant fluctuation reflects a broader spectrum of movements within the top ten cryptocurrencies, showcasing varied performances. Amidst these developments, the overall market capitalization has seen a modest increase, signaling a nuanced yet optimistic outlook among investors.

The cryptocurrency market is witnessing divergent trends among its leading currencies. Notably, Bitcoin’s slight dominance increase underscores its pivotal role, despite trading below the $68,000 threshold. In contrast, Solana (SOL) has emerged as a notable gainer, appreciating by over 9%, an indication of the growing investor confidence in its potential. Meanwhile, Dogecoin (DOGE) and Ethereum (ETH) have experienced declines, shedding light on the market’s volatility and the varying investor sentiments driving these movements.

The market’s overall capitalization has grown to $2.76 trillion, marking a 1.05% increase. This uptick suggests a cautiously optimistic outlook among participants, buoyed by the performance of select cryptocurrencies. Moreover, the Bitcoin dominance index sitting at 49.4% further emphasizes its influence on the market’s direction. Additionally, the Fear & Greed Index, at a high of 81, points to a state of ‘Extreme Greed,’ reflecting the heightened enthusiasm and speculative interest pervading the market.

Amidst the mixed performance of mainstream cryptocurrencies, several altcoins have posted remarkable gains. LeisureMeta (LM) leads this pack with a staggering 67.3% increase, followed closely by Raydium (RAY) and Jupiter (JUP), which have surged by 64.7% and 52.1%, respectively. These gains highlight the dynamic nature of the cryptocurrency market, where emerging tokens can rapidly gain prominence and investor attention.

The current state of the cryptocurrency market illustrates a complex interplay of optimism, speculation, and strategic investments. With Bitcoin maintaining its central role despite minor setbacks, and altcoins like Solana, LeisureMeta, and Raydium making significant strides, the landscape continues to evolve. Investors and enthusiasts alike are closely monitoring these developments, eager to navigate the opportunities and challenges that lie ahead in the digital currency domain.