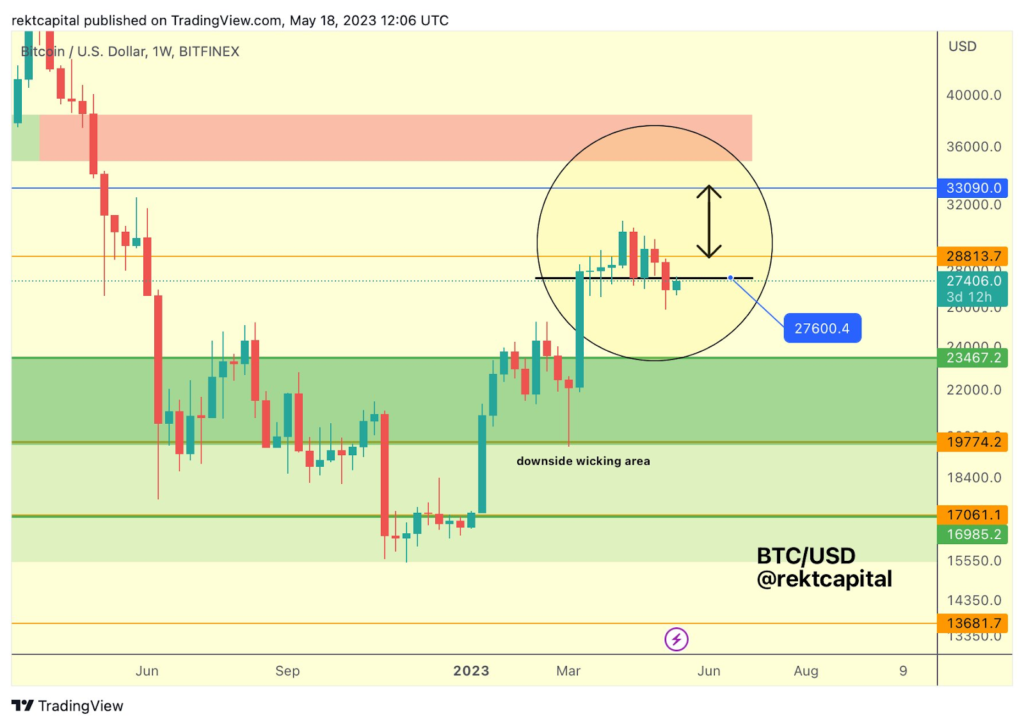

Crypto trader Rekt Capital has signaled a confirmed Bitcoin (BTC) downtrend based on a 1W close in black below $27,600. The writer of the Rekt Capital newsletter said that BTC needs to reclaim the $27,600 price level to ensure a bullish momentum from its current price of $27,041.

Rekt Capital tweeted:

#BTC still below ~$27600 (black) as the week slowly comes to a close

— Rekt Capital (@rektcapital) May 18, 2023

A 1W Close below black would double-confirm a breakdown from ~$27600 & could set $BTC up for downside continuation

Price needs to reclaim $27600 to have a chance at bullish momentum from here#Crypto #Bitcoin https://t.co/gFxMwMFEgj pic.twitter.com/LNiTgV9lLp

The crypto analyst shared a graph highlighting BTC’s recent price behavior in which he sees a downside wicking area between $22,000 to $19,774.2. He maintains that above the $22,000 price level, and above the $23,467.2 price point, up until the $33090 area, a massive green candle bull trend might ensue.

Prior to that, Rekt Capital shared another tweet where he noted that a rejection at $27,570 (in black) by BTC would trigger a downside. Rekt Capital had also expressed concern over BTC potentially being unable to reclaim the $28,800 price point.

In related Bitcoin news, stablecoin issuer Tether International Limited has announced to allocate to its stablecoin reserves 15% of net realized operating profits to buy BTC. Tether also said that these BTC in question would be above the minimum reserves assets that 100% back tether tokens.

Paolo Ardoino, CTO of Tether, reasoned the resilient strength and future potential of BTC as a strategic store of value given its increasing adoption. He said that the “decision to invest in Bitcoin, the world’s first and largest cryptocurrency, is underpinned by its strength and potential as an investment asset”, adding:

Its limited supply, decentralized nature, and widespread adoption have positioned Bitcoin as a favored choice among institutional and retail investors alike.

Our investment in Bitcoin is not only a way to enhance the performance of our portfolio, but it is also a method of aligning ourselves with a transformative technology that has the potential to reshape the way we conduct business and live our lives.

As per Tether’s Q1 2023 Assurance Report, as of March 2023, Tether owns approximately $1.5 billion in BTC in its reserves.