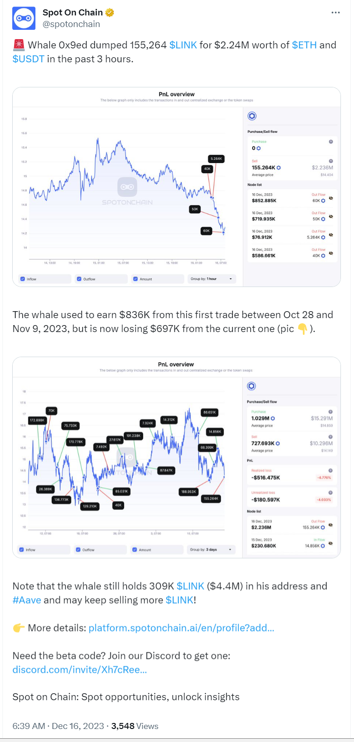

In a significant move within cryptocurrency, a recent transaction by a notable ‘whale’ has caught the attention of market analysts, as highlighted by Spot On Chain, an analysis platform. On December 16, 2023, a major crypto holder, known by the address 0x9ed, executed a significant move that involved the sale of a massive 155,264 $LINK, acquiring a combined $2.24M in Ethereum ($ETH) and Tether ($USDT).

The transaction history of this whale reveals a complex play. Between October 28 and November 9, 2023, the same entity profited by $836K from an earlier trade. However, the current transaction marks a notable loss of $697K. Despite this, the whale’s portfolio remains substantial as they own 309K $LINK, valued at approximately $4.4M, held in an Aave address. The analyst hinted that the holding suggests potential future sales of $LINK.

Significantly, the market has been notably responsive to these transactions, garnering keen interest from investors. Detailed data compiled by Spot On Chain revealed discernible patterns in the trading activity of large-scale investors. Line graphs have been employed to depict how the asset’s value has fluctuated over time, with the x-axis denoting time and the y-axis representing price in USD. Furthermore, key transactions, ranging from 5.264K to a substantial 852.885K, have been thoughtfully annotated to highlight significant inflows and outflows of the asset.

Moreover, the data included specific details on the nodes where transactions occurred. These insights provided clarity on the whale’s strategies. For instance, the annotations ‘Sell’ and ‘Purchase’ shed light on the trading volume. They indicate a total sell volume of 155.264K, equivalent to $2.236M, with no purchases in the observed timeframe.

Additionally, the average price at which the asset was sold is listed as $14.404. This figure, coupled with the annotated inflows and outflows, painted a comprehensive picture of the whale’s market manoeuvres. Notably, a red line with an arrow in the graph suggests a substantial outflow of funds, aligning with the large LINK sale.

Consequently, these transactions have broader implications for the crypto market. They highlight the influential role of large holders in shaping market dynamics. Hence, traders and analysts closely watch these moves, anticipating their potential impact on the LINK, ETH, and USDT markets. This event underscores the volatile and ever-evolving nature of the cryptocurrency landscape, where a single transaction can ripple across the market.