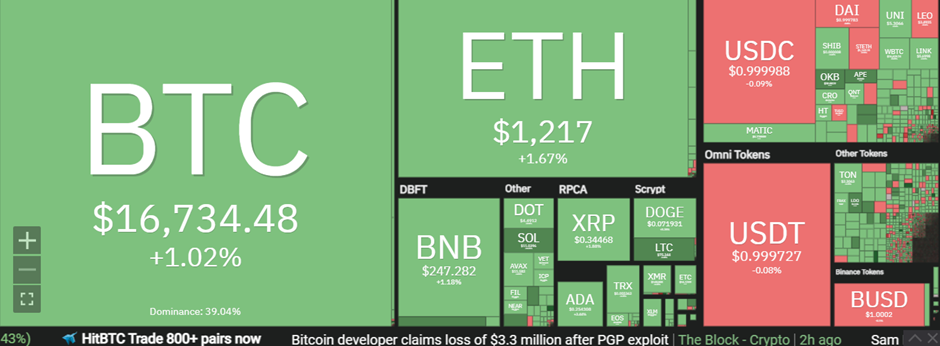

Bitcoin and Ethereum, the two largest cryptocurrencies, continued their recent recovery and added around 1.5% to their market value. The list of the top 10 coins is currently trading in a mini rally as the total market capitalization increased from $790 billion to $805.6 billion over the last 3 days. Most altcoins followed the trend and topped recent gains, with coins such as Polkadot and Ripple seeing significant gains of 4.38% and 5.50%, respectively. The top performer of the day is Lido DAO and OKB coin.

Despite the general increase in the cryptocurrency market, the overall market volume has seen a decline over the week. CryptoCompare statistics have indicated an abrupt decrease in crypto transactions in December 2022. The globally recorded peak crypto trading figures on the 8th of November were purportedly estimated at $115.33 billion, culminating in a minimal recital of $22.95 billion for the 1st day of January 2023.

This lack of significant movement and volume indicates that the market is in a consolidation phase, and investors are hesitating before adding their money to the cryptocurrency market. This could be an indication that there is a need for further research on blockchain technology and its associated functional structures.

Although crypto prices remain in a bullish trend, the decrease in trading volume also gives evidence to the fact that the market is looking to devise its next wave of investment opportunities. This suggests that projects such as DeFi, layer two solutions, tokenization, and STO are gathering interest from investors. These new business models could further drive innovation across the crypto space.

Bitcoin price analysis

Bitcoin is trading near $16,800, AT the moment, Bitcoin is playing within a consolidation range and is showing few signs of moving out of this zone, as the volume is quite low. Bitcoin has been exhibiting signs of stability on the first day of 2023 and the current bullish trend may signal a budding bull market for Bitcoin if it can break out of the consolidation zone it’s currently in. Moving forward, Bitcoin investors will be waiting for the market to give them a signal on whether the upwards trajectory can be pushed forward with momentum.

On the technical side, analysts are expecting Bitcoin to maintain its current range until it can break the $18,000 resistance level. If the price moves above this level, higher prices will be anticipated. For that to happen, the bulls will need to hold the support line and prevent a selloff. On the other hand, the bears may also push the price down if they can get the market to panic sell. Ultimately, the journey of Bitcoin in 2023 will depend on the continuation of its bullish trend, investors’ investment decisions, and the actions of the bulls and bears.

If Bitcoin is able to break through the $18,000 resistance level and keep the momentum, this will be a sign that the cryptocurrency is on track for sustained price increases, resulting in a bullish market particularly once buyers start entering the market in stronger numbers.

Analyzing the MACD and the latest RSI for Bitcoin, both indicators appear to support the potential for continued price surges. The MACD line has broken above the signal line and moved into positive territory, indicating a bullish trend as the current trend of higher highs and higher lows is still intact. Furthermore, The RSI is also currently indicating a bullish sentiment with an index reading above 50.

Ethereum price analysis

The Ethereum price is currently trading around the $1217.59 level, representing a significant 1.79% increase over the past 24 hours. The uptrend has been gaining momentum in the last day or so, reaching the important level of $1,200 after a two-week consolidation period during which it ranged between $1,150 and $1,175. This strong price surge is being supported by strong trading volume and a healthy technical outlook, with the MACD line crossing above the signal line and the RSI currently registering around 69.

The Ethereum price is currently testing several resistance levels, such as the $1,225 and $1,235 marks, but if it is able to break above these levels, then the next key target will be the all-time high of $1,450. If this level is met, it may be The key technical level to watch for continues to be the 50-day moving average, which is currently holding at $1,146. If the Ethereum price can break through that level, then it could result in a significant rally to the upside.

Overall, ETH is in a minor bullish position and may be able to break through the resistance levels it is currently encountering. A strong push past the $1,450 level could trigger a bullish run-up in the Ethereum price and could open the door for the digital asset to test the psychological $2000 level.