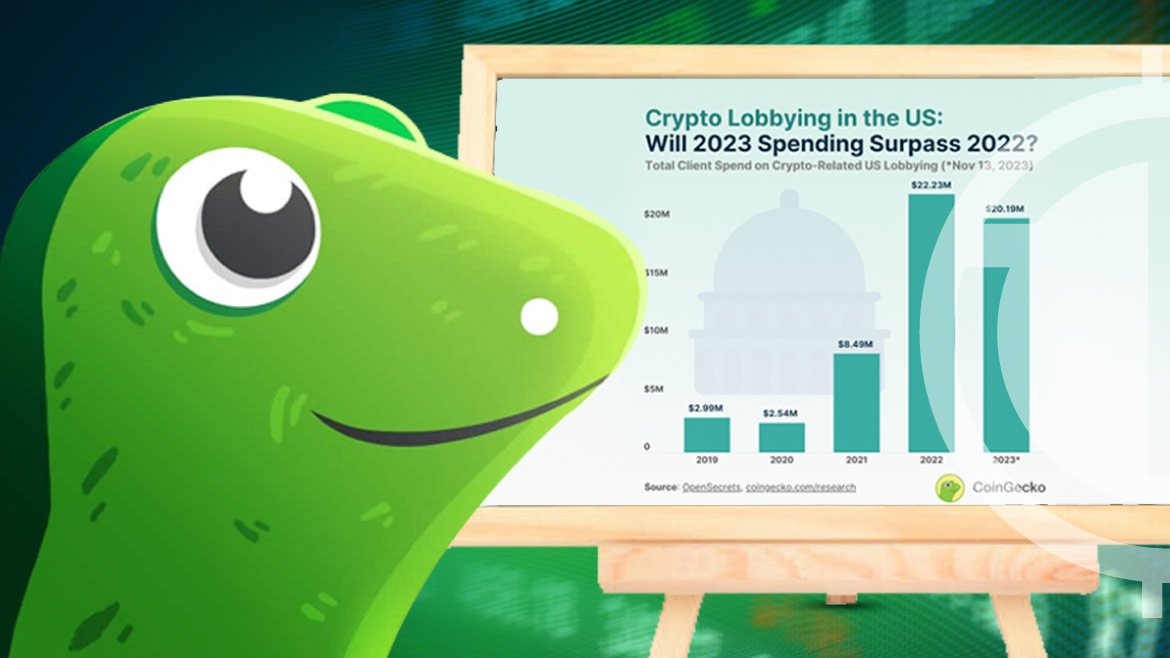

In the span of five years, the crypto industry has made significant strides in lobbying efforts within the United States, expending a staggering $56.44 million to influence policy decisions. An array of 66 companies and 12 organizations collectively advocated for crypto-related issues, highlighting a concentrated effort by 78 non-individual entities to shape the regulatory landscape in Washington.

According to a recent report, the landscape of crypto lobbying expenditure underwent notable fluctuations throughout this period. Initial years, particularly 2019 and 2020, witnessed comparatively modest spending, totaling $2.99 million and $2.54 million, respectively. These amounts represented a mere fraction of Wall Street’s lobbying power, signifying limited influence within policy corridors when the crypto market was experiencing a downturn, hovering below the half-trillion-dollar mark.

However, the tides swiftly turned amidst the bullish surge of 2021. Crypto lobbying spending tripled to $8.49 million, reflecting 7.2% of Wall Street’s lobbying budget, concurrently with the market cap surpassing the trillion-dollar milestones. The subsequent year, 2022, saw an unprecedented high in crypto lobbying expenditure, escalating to $22.23 million, more than doubling year-on-year.

This surge coincided with a rise in participating entities, with newcomers like Crypto.com, TaxBit, Tether, and Kraken emerging as top spenders. The current year, 2023, has already witnessed a spend of $20.19 million, hinting at a potential surpassing of the 2022 figures by year-end. Impressively, this year’s crypto lobbying spend constitutes 19.7% of Wall Street’s efforts, suggesting a potential acceleration in crypto’s influence on Washington’s decision-making processes.

Despite the setback triggered by the FTX collapse and subsequent regulatory scrutiny, the crypto lobbying landscape has seen stalwarts like Coinbase, Blockchain Association, and Ripple consistently leading the charge, each investing millions in lobbying efforts over the five years.

New entrants such as Andreessen Horowitz (A16Z), OKX, Polygon, Solana, and Discover Crypto have also stepped into the lobbying arena, showcasing a diversification of influencers seeking a say in shaping crypto-related policies.

The top 30 entities in crypto lobbying have dominated the scene, accounting for 82.1% of the total expenditure. Notably, Coinbase leads the pack, having dedicated $7.51 million, closely followed by Blockchain Association and Ripple.

Based on data from OpenSecrets, the insights shed light on the growing influence of the crypto industry in Washington. As the sector’s lobbying efforts continue to evolve and expand, their impact on regulatory decisions could redefine the future landscape of digital finance.