- Bitcoin hovers below $30k, seeking a breakout past $30,093 resistance.

- Ethereum’s sideways trend continues, facing bearish pressure around $1,849.

- APT and RPL surge, while OP and INJ face significant losses.

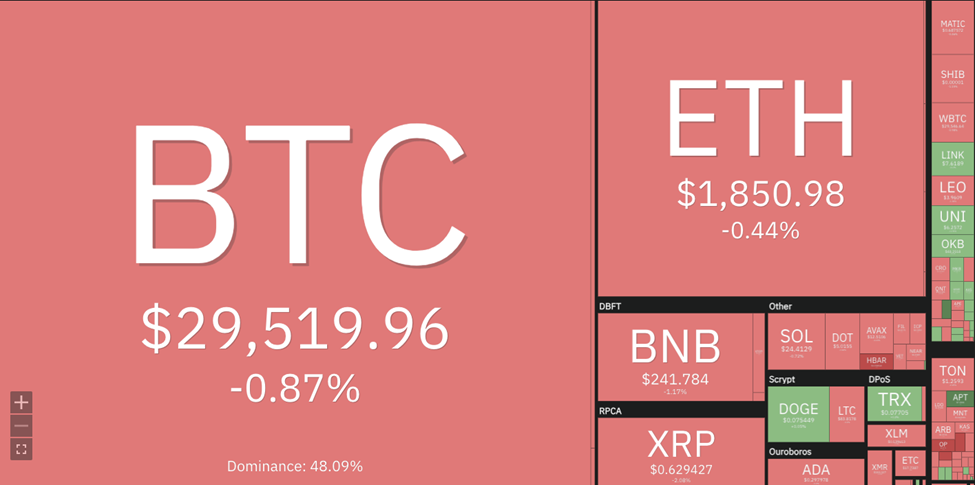

Today’s market analysis showcases a diverse landscape in the dynamic world of cryptocurrencies, with major digital assets displaying bullish and bearish trends. The center stage is occupied by the leading virtual asset Bitcoin (BTC), grappling to gain a foothold above the pivotal $30k level.

After encountering a resistance level of $30,093 in the preceding session, BTC underwent a corrective phase, resulting in its current lateral movement within the $29,477 to $29,500 range. At the time of writing, BTC reflects a modest 0.87% loss and is valued at $29,519.

ICO Drops, a platform that provides a simple and visually appealing Initial Coin Offering (ICO) and Initial Exchange Offering (IEO) calendar, shared a tweet post providing insights on the current market performance:

Crypto Market Daily Review ☀️

— ICO Drops (@ICODrops) August 10, 2023

The market is neutral. Market cap is $1.18T. Bitcoin is trading at $29.5K

💧https://t.co/ISCEGex4sm pic.twitter.com/rulSzAWTND

Meanwhile, Ethereum (ETH) is treading water, mirroring the overall market sentiment. The bearish undertone is becoming more pronounced as ETH hovers around the $1,850 mark, experiencing a 0.44% decline. Critical monitoring levels are the support at $1,845 and the resistance at $1,869, which could influence Ethereum’s trajectory in the coming days.

Meanwhile, Binance Coin (BNB) emerges as an intriguing case, showcasing robust performance recently. However, the current scenario paints a bearish picture. BNB’s encounter with formidable resistance at $250 led to renewed selling pressure, causing its price to retest to $241, marking a 1.30% drop over the past 24 hours.

The market also gravitates towards XRP, which has been locked in a tight range since the week’s commencement. Bouncing off the substantial support at $0.6200, XRP currently trades at $0.6272, showing a marginal 2.29% decrease within 24 hours and a 5% dip over the past week.

On the other hand, Uniswap (UNI) is up by 1.37% and is currently trading at $6.22. After a strong surge above $6.00, the altcoin has been struggling to maintain its bullish momentum after failing to break above a strong resistance level of $6.31. The support is present at $6.09, and the resistance is seen at $6.50. If UNI breaks above the $6.31 level, it could surge higher toward its all-time high of $7.61. However, if the bulls fail to break this level, then the price may move back below $6.09 and test the support levels of $6.00 and $5.95 respectively.

A glance at the leaderboard highlights top gainers Aptos (APT) and Rocket Pool (RPL), showcasing remarkable gains of 9.13% and 5.50%, respectively, over the past 24 hours. Aptos has surged to $7.31, with an evident bullish force driving its bid to conquer the $7.93 resistance level and perpetuate the prevailing bullish sentiment. Rocket Pool (RPL) has seized the bullish momentum since daybreak, piercing through the $27.00 resistance and now trading at $27.20, representing a 5.50% uptick in the last 24 hours.

On the flip side, market losers are highlighted by the downward trajectory of Optimism (OP), experiencing a significant 7.06% decrease, and Injective (INJ), which saw a decline of 5.85%. As of now, OP is priced at $1.57, while INJ is trading at $7.59 within the previous 24-hour period.

The overall market panorama underscores neutrality among most major cryptocurrencies, each displaying a unique interplay of bullish and bearish forces. Essential markers, such as support and resistance levels, serve as compasses for investors navigating this dynamic landscape. As the market unfolds, traders are advised to adapt their positions following the prevailing conditions, all while keeping a vigilant eye on potential breakout or breakdown scenarios.