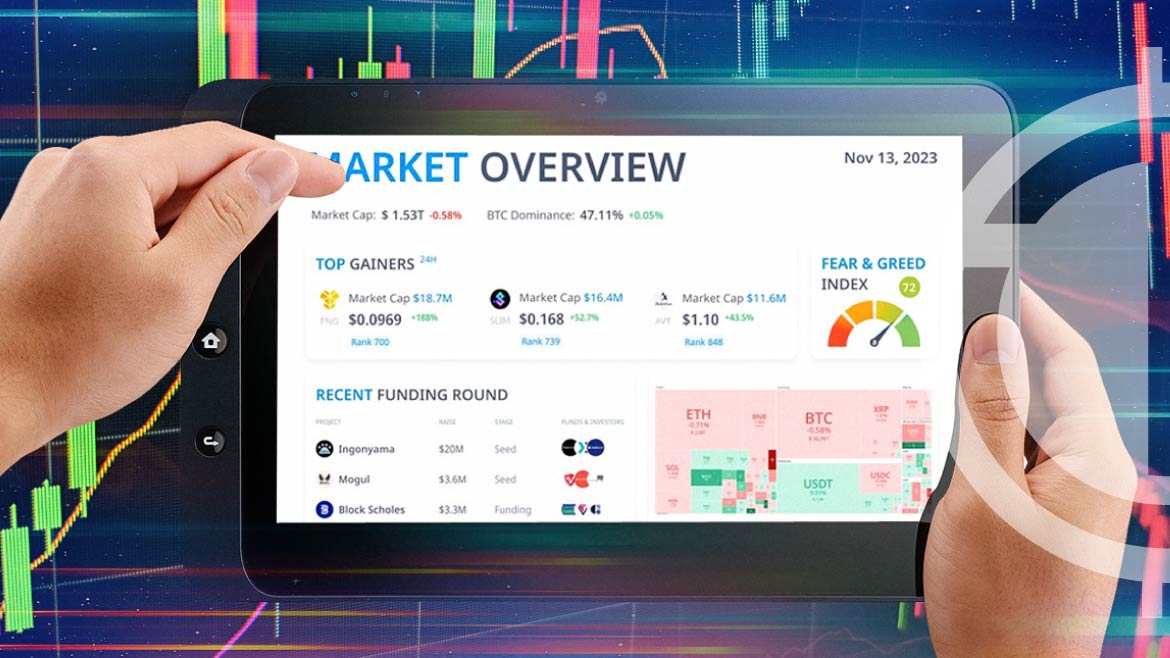

- Bitcoin’s dominance grows slightly to 47.11% despite market dip, showing enduring investor interest in the leading cryptocurrency.

- Cardano, Dogecoin, and BNB experience downturns after recent gains, highlighting the volatility and rapid changes in crypto markets.

- Crypto market cap contracts to $1.53T, yet Fear & Greed Index at 72 suggests investors remain optimistic amid fluctuating values.

In the dynamic world of cryptocurrencies, Bitcoin continues to be a dominant player. However, recent market trends show a slight downturn. Currently, Bitcoin is trading below $37,000. According to CryptoRank, a prominent blockchain analyst, this slight dip is echoed across the top-10 cryptocurrencies. These assets are trading in the red zone, indicating a cautious market sentiment.

Notably, Cardano (ADA), Dogecoin (DOGE), and BNB are experiencing declines. ADA’s value has decreased by 2.23%, with its price at $0.376840. After witnessing a 9.38% increase in the previous week, Cardano’s value has seen a downturn.

Similarly, Dogecoin’s price has dropped by 2.70%, to $0.077117, after rising by 8.18% over the previous week. BNB’s current price likewise fits this trend, hovering at $245.73. After a slight increase of 0.60% the previous week, the cryptocurrency experienced a decline of 1.53%.

The total market capitalization of cryptocurrencies stands at $1.41trillion, showing a minor contraction of 0.58%. Within this landscape, Bitcoin’s market dominance is slightly increasing, now at 47.11%. This marginal growth of 0.05% suggests a steady interest in Bitcoin compared to other cryptocurrencies.

The Fear & Greed Index, a measure of investor sentiment, is currently at 72, indicating a state of greed in the market. This suggests that investors are optimistic, despite the minor setbacks in cryptocurrency values.

In terms of trading volume, Bitcoin remains active with $22.33 billion in the last 24 hours. Its market cap is substantial at $724.21 billion. Cardano’s trading volume is at $366.66 million, and Dogecoin at $954.09 million. BNB’s 24-hour trading volume stands at $684.52 million.

The circulating supplies of these cryptocurrencies also paint a diverse picture. Bitcoin’s circulating supply is about 19.54 million BTC. Cardano has a much larger supply of 35 billion ADA, and Dogecoin’s supply is even larger at 140 billion DOGE. BNB has a comparatively smaller circulating supply of 150 million units.

These trends in the cryptocurrency market highlight the volatile nature of this digital asset class. While Bitcoin maintains its lead, the fluctuations in other top cryptocurrencies reflect the constantly changing investor sentiments and market dynamics.