- Bitcoin fights to maintain its ground, aiming for the $30K resistance level.

- Ethereum struggles to rebound, eyeing a possible rally towards $2000.

- Altcoins like MKR, TON, TRX, and RUNE emerge as top gainers, signaling investment potential.

As cryptocurrency enthusiasts eye September 2023, the market appears to be in a state of flux, oscillating between bullish and bearish trends. With both bears and bulls striving to dominate, investors are looking for opportunities to make gains amid the uncertainty.

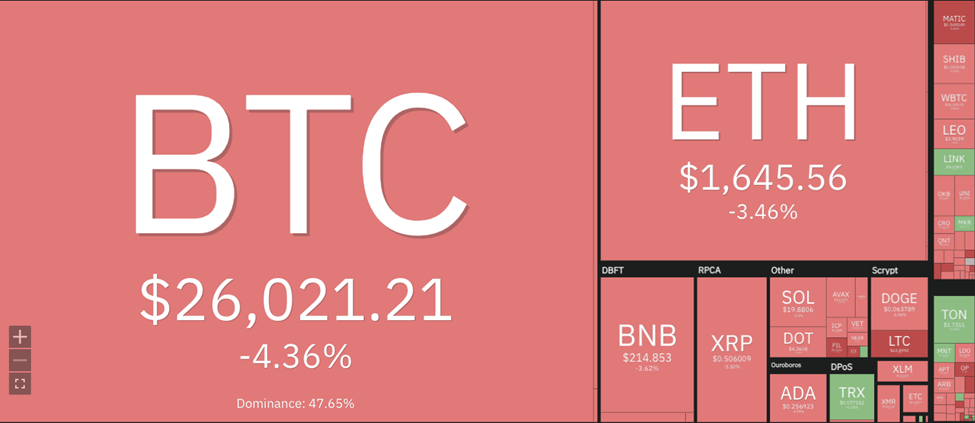

Bitcoin (BTC), the leading digital asset, currently showcases a market capitalization near $506 billion. BTC prices have traded below the $30k resistance level for most days and weeks with bearish momentum. With bearish sentiment, Bitcoin’s price has been confined between $25,000 and $27,000 for several weeks. At the time of writing, BTC is at $26,021, with a recent 24-hour price dip of 4.36%.

As September unfolds, the $30k mark serves as a crucial resistance level for Bitcoin. If bulls succeed in breaking the $30k resistance level, then BTC could rise to a new all-time high. However, if bears continue to take control, BTC could slump to the $25k support level, which is the closest support.

Following Bitcoin, Ethereum (ETH) stands as the second-largest cryptocurrency by market capitalization. At the moment, Ethereum is trading at $1,645, showing a 24-hour decrease of 3.46%. Recent market behavior has seen Ethereum’s price fluctuating between $1,600 and $1,700.

An attempt to breach the $1,800 resistance was unsuccessful, leading to consolidation around current levels. As the month advances, a breakthrough above $1,800 could set Ethereum on course to hit $2,000. On the downside, if bearish trends persist, Ethereum might decline to the $1,500 support.

The Binance Coin (BNB) has faced notable downward pressure lately, dipping below the $250 mark. As of now, BNB is trading at $213, with a 24-hour decrease of 4.38%. If the bearish trends endure, the coin could touch down at $210. However, a bullish rebound might propel BNB to $230.

XRP, another significant player in the crypto arena, is experiencing tight trading conditions. Currently, XRP is priced at $0.5054, with a marginal 24-hour decrease of 1.11%. For XRP to witness any meaningful recovery in September, the support level of $0.45 needs to be held. Otherwise, a continuation of bearish trends could drive the coin down to $0.40.

Looking at the top gainers in CoinMarketCap in the past 24 hours, MKR, TON, TRX, and RUNE have displayed remarkable resilience, with their prices surging by 5.95%, 2.14%, 1.68%, and 1.30% respectively. MKR leads the pack at $1,146, followed by RUNE at $0.77736 and TON at $1.72. Their recent momentum could spell greater gains, making them the ones to monitor closely.

On the flip side, the top losers are Optimism, RNDR, CFX, and GMX. Their prices dipped by 6.82%, 6.77%, 6.69%, and 6.48%, respectively. With Optimism currently at $1.38, RNDR at $1.35, and CFX at a mere $0.1235, their bearish trend might extend if the negative momentum prevails.

In conclusion, September 2023 shapes up to be a defining month in the cryptocurrency saga. Investors and enthusiasts must stay vigilant, as both support and resistance levels would play crucial roles in dictating the fate of these digital assets. The unpredictability intrinsic to this market requires a blend of caution and optimism for anyone looking to capitalize on the potential shifts.