- Ki Young Ju, CEO of CryptoQuant, reveals strategic moves of Bitcoin whales and market dynamics in a recent tweet thread.

- Miners invest in rigs, pushing the hash rate to all-time highs and Whale traders opened “giga-long positions” at $29k and were hesitant to dump BTC.

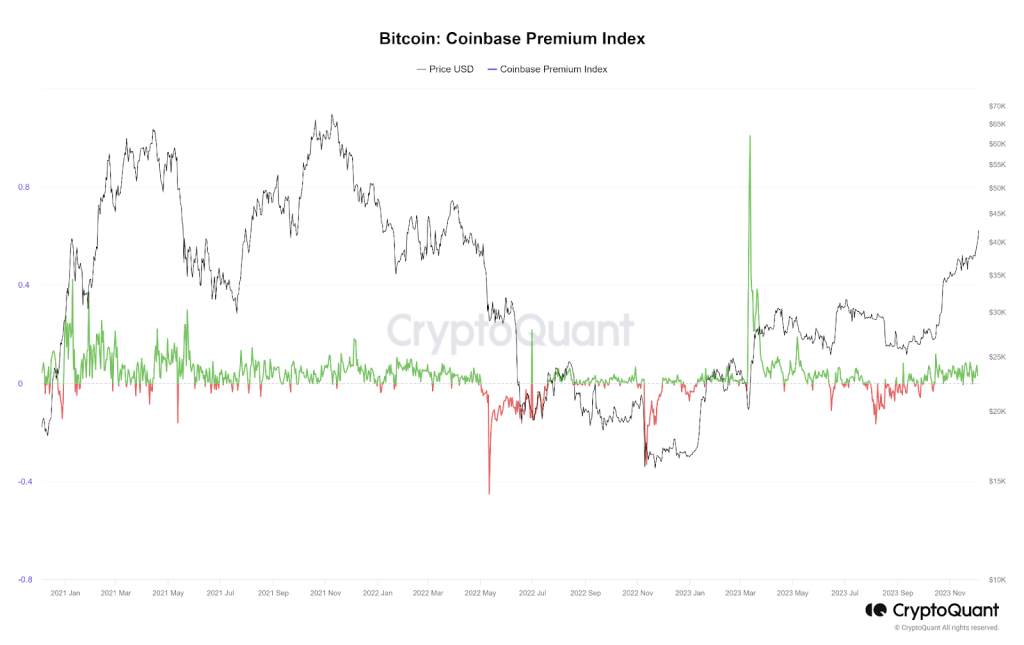

- Coinbase Premium spikes were monitored for potential US investor demand, tracking institutional whale movements.

In a recent tweet thread, Ki Young Ju, the CEO of South Korean on-chain analytics resource CryptoQuant, sheds light on the strategic moves of Bitcoin whales and the evolving market dynamics. The tweet thread attempts to shed light on the metrics that unveils the miners’ confidence surging with the rapidly increasing massive whale transfers.

Ki Young Ju highlighted that miners are consistently investing in mining rigs, pushing the hash rate to all-time highs. On November 9, he tweeted stating that with 155 days left before the halving, the estimated mining cost per coin might exceed $36k. Despite the current BTC price standing at $35k, miners are confident that post-halving, the BTC price is expected to surpass $36k, given their approximate mining cost per coin at $18k.

Whale traders, according to Ki Young Ju’s observations, opened “giga-long positions” at $29k, signaling a bullish stance in the market. The “interexchange flow pulse” indicator, measuring cumulative net flows between Coinbase and derivative exchanges, supports this sentiment. Historically, when this indicator rises above the 90-day moving average, Bitcoin enters a bull market, as seen in 2017 and 2019-2021.

Coinbase and CME price premium spikes are also being monitored as potential indicators of demand from US investors. The Coinbase Premium, reflecting the gap between Coinbase Pro and Binance prices, serves as a crucial metric for tracking institutional whale movements. Investors keenly observe trends and fluctuations in the premium to gauge the sentiment of Coinbase whales.

These tweets and analyses by CryptoQuant’s CEO and other industry experts provide a comprehensive overview of the current scenario, offering valuable insights into the strategies of whales, miners’ confidence, and the anticipation of retail trader participation. Kim Young Ju also tweeted crediting another CryptoQuant analyst Mikołaj Zakrzowski, saying,

Unlikely whales dump BTC at the moment due to lack of exit liquidity from retailers. The market would be boring until significant fiat/stablecoin inflows tho.

Interestingly, retail traders, identified as the exit liquidity, have yet to join the market. Whales seem reluctant to dump BTC at the moment due to the absence of exit liquidity from retailers. While the market awaits significant fiat/stablecoin inflows, the lack of retail participation suggests a somewhat stagnant phase.

Mikołaj Zakrzowski’s cyclical indicators, including the Adjusted MVRV Ratio, Cumulative Value Days Destroyed, Investor Cap, SOPR Ratio, Realized Cap < 1 Month (%), and Supply in Profit (%), provide insights into Bitcoin’s long-term trends and potential market bottoms. These metrics, created by industry experts, aim to spot pricing inefficiencies and measure market sentiment.

The Bitcoin world is buzzing with activity, due to the key catalysts outlined by Layergg, a crypto analysis platform. This surge is transforming how people trade and invest in cryptocurrency. The upcoming Bitcoin halving and possible approval of Bitcoin Spot ETFs are major catalysts.