- Decentraland’s $MANA faces a notable market shift as the TD Sequential indicates a sell signal, forewarning potential correction.

- Beyond TD Sequential, diverse indicators like RSI and moving averages align, reinforcing signals of a market correction.

- Broader market dynamics and regulatory uncertainties heighten $MANA’s vulnerability, warranting cautious investor navigation.

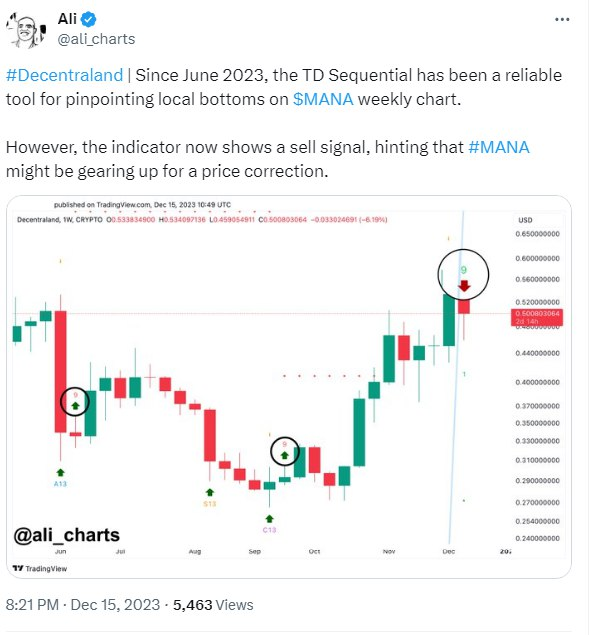

In the fast-paced realm of cryptocurrency markets, keen investors and traders always seek reliable tools to navigate the ever-changing landscape. Recently, a noteworthy development has caught the attention of seasoned analysts, particularly within the Decentraland ($MANA) community. Since June 2023, the TD Sequential indicator has stood as a stalwart companion for discerning local bottoms on the weekly $MANA chart.

In a recent tweet, experienced crypto analyst Ali highlighted a concerning sell signal on Decentraland’s $MANA, revealing a potential price correction.

As the months unfolded, investors found solace in the indicator’s ability to pinpoint opportune entry points. However, the tides appear to be shifting, as the TD Sequential now presents a sell signal. This critical juncture hints at the possibility that Decentraland might be on the brink of a price correction, prompting investors to reassess their positions and risk management strategies.

Decentraland’s $MANA is currently priced at $0.4892, reflecting a 1.80% decrease in the last 24 hours. The market cap stands at $926,080,117, positioning it at #72 in market rankings. Trading volume has surged by 29.99%, totaling $71,248,490 in the last day, with a volume/market cap ratio of 7.68%. The circulating supply of $MANA is 1,893,095,371, accounting for 1.81% of the total supply, which amounts to 2,193,179,327 $MANA. These figures suggest a dynamic market with potential trends for traders to monitor closely.

Delving into the intricacies of the TD Sequential, its historical reliability cannot be overstated. For over six months, this technical indicator has consistently aided in identifying potential trend reversals and entry points for traders. Its ability to highlight local bottoms on the $MANA weekly chart served as a beacon of hope for investors seeking clarity amid market volatility.

Nevertheless, no tool is infallible, and the recent emergence of a sell signal demands meticulous attention. The sell signal, a potent indicator of potential price correction, signals a shift in market sentiment. For traders and investors, this serves as a crucial juncture to reassess risk exposure and consider potential downside scenarios.

Adding further context to the analysis, the broader crypto market trends must be considered. Decentraland’s recent performance should be viewed against the backdrop of the overall market conditions, taking into account factors such as Bitcoin’s dominance, macroeconomic trends, and regulatory developments. A holistic approach to market analysis ensures a comprehensive understanding of the forces at play, beyond individual coin metrics.

As the crypto community grapples with this new development, it is paramount to exercise prudence and diligence. A sell signal does not necessitate panic; rather, it serves as a call for a measured response. Seasoned traders understand the importance of adapting to changing market conditions and using such signals as an opportunity for strategic adjustments.

In conclusion, Decentraland’s $MANA has enjoyed a resilient journey, guided by the insights provided by the TD Sequential indicator. However, the emergence of a sell signal urges investors to approach the current scenario with vigilance. The intricate dance of market forces requires a nuanced response, emphasizing the need for a comprehensive analysis that goes beyond individual coin dynamics. As the crypto market continues its perpetual ebb and flow, staying informed and adaptable remains the key to navigating the waves of uncertainty.