- Uniswap achieved a remarkable trading volume of $2 trillion, surpassing the economic outputs of Australia, Brazil, and South Korea.

- Within just 24 months, Uniswap doubled its trading volume from $1 trillion, showcasing rapid growth in the decentralized finance sector.

- The exchange supports multiple blockchains, contributing to its widespread adoption and the leading position in the DEX market.

Uniswap, a decentralized exchange, has surpassed $2 trillion in cumulative trading volume. This achievement comes five and a half years after its inception in November 2018. Uniswap’s trading volume now exceeds the gross domestic product of several major economies, including Australia, Brazil, and South Korea. This milestone reflects the growing importance and user base of decentralized financial platforms.

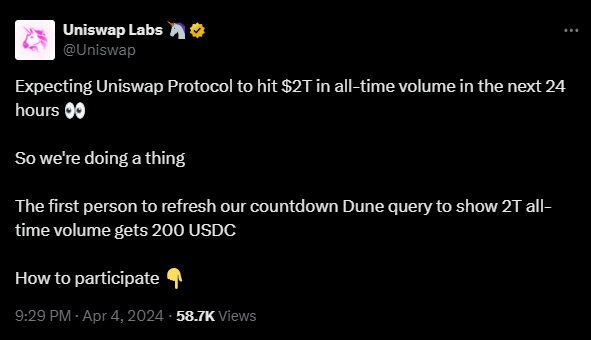

The exchange first announced the likelihood of reaching this milestone on April 4, projecting it would occur within the next 24 hours. True to their prediction, the $2 trillion mark was reached at approximately 11:55 a.m. UTC on April 5. This information was verified through data presented on a Dune Analytics dashboard maintained by Zach Wong, Uniswap’s strategy and operations lead.

Moreover, Uniswap Labs celebrated this accomplishment by offering a $200 reward in USD Coin to the first individual who captured and shared a video of the moment the trading volume reached $2 trillion. This initiative not only engaged the community but also underscored the milestone’s significance.

Uniswap’s swift growth trajectory showcases its ability to attract substantial trading volume in a relatively short period. It took the platform 42 months to amass its first trillion in trading volume and, notably, just 24 months to secure the second trillion. This acceleration in trading activity indicates Uniswap’s resilience and adaptability in the face of intensified competition within the decentralized exchange landscape.

The platform’s extensive support for various blockchains, including Ethereum, Polygon, Optimism, Arbitrum, Celo, BNB Chain, Base, Blast, and Avalanche Network, has been instrumental in facilitating its vast trading volume. This multi-chain approach allows users from different blockchain ecosystems to participate, enhancing Uniswap’s accessibility and utility.

According to data from Dune Analytics, as the largest DEX by trading volume, Uniswap continues to lead the sector with a weekly trading volume of $21.6 billion. Competitors such as PancakeSwap, Curve, Balancer, and Trader Joe follow, with volumes ranging significantly lower, from $9.6 billion to $800 million.

Uniswap’s token UNI is currently trading at $10.73, down 4.68 in the past 24 hours. Over the past month, UNI has been trading in a descending channel, dropping from $15 to $10, an 18% decline. The market capitalization is $6 billion, while the trading volume is $153 million.