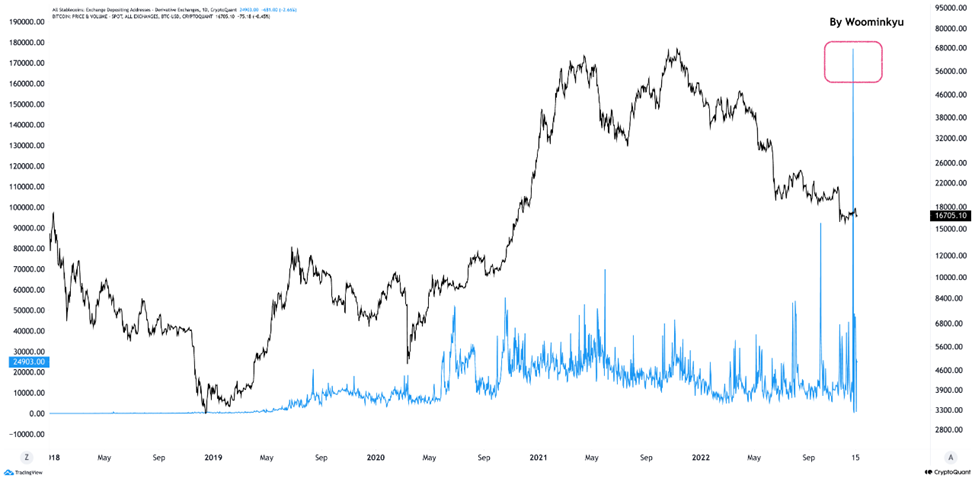

Recently, stablecoins transfers to all derivative exchanges have hit an unprecedented high. This suggests that the buying pressure is at an all-time high, indicating that more investors are looking to take action in derivative trades. It appears that the demand for these coins is at its strongest ever, and this is further bolstered by the increasing volume of these stablecoin deposits.

One of the most noticeable effects of this latest rise in stable coin deposits is that it has led to a record number of transactions being made by coin depositors. This means more people are investing in derivatives, as well as buying and selling these coins on various exchanges. This could be an indication that investors are becoming more confident in their investments, as well as the stability of the overall market. It is also indicative that more people are joining in on trading derivatives, which could lead to a further surge in their popularity among investors.

This rise in transactions is also encouraging for exchanges, who can benefit from the increased fees they charge for these trades. As more people join in on derivative trades, hosting these trades becomes more profitable for exchanges, which can lead to them providing better services and expanding their offerings.

Overall, this recent surge in stable coin deposits is very encouraging. It is an indication that more people are getting involved in derivative trades, as well as being a sign of investor confidence in the market. This could mean good things for exchanges and investors alike, as more people participate in derivatives trading and the market remains stable. It is clear that these deposits are having a major effect on the overall market, and it will be interesting to see how this trend continues in the future.

Is this an indication of a bull run?

There is some hope that this surge in stable coin deposits could indicate that the market is on track toward a bull run. While it is too early to make any definitive conclusions, there are some signs that investor confidence is high and more people are getting involved in derivative trades, which could signal an increase in prices. Ultimately, only time will tell if this trend continues and leads to a bull run, but for now, this growth in stable coin deposits is certainly an encouraging sign.

Overall, it is clear that the recent surge in stable coin deposits is having a major effect on the market. This has led to more transactions being made by coin depositors and likely indicates an uptick in investor confidence. This could be an early sign that the market is on its way to a bull run, and it will be interesting to see how this trend continues in the future.

Conclusion

This rise in stable coin deposits to all derivative exchanges is very promising. It is an indication that more people are getting involved in trading derivatives, as well as being a sign of investor confidence in the market. It could mean good news for exchanges, who can benefit from increased fees, and for investors who are looking for more secure investment opportunities. Ultimately, it will be interesting to see how this trend continues in the coming months and years.