- Dogecoin (DOGE) experiences a slight price increase amidst a week of sharp declines, highlighting volatile market conditions.

- A bullish pattern on DOGE’s 6-hour chart suggests potential for recovery, despite ongoing challenges in market sentiment and profitability metrics.

- With only 79% of DOGE investors currently profitable, the cryptocurrency faces continued bearish pressures and a declining social popularity.

Dogecoin (DOGE) finds itself caught in a broader downturn as bearish sentiments grip the sector. Despite recent setbacks, analysts are closely monitoring potential indicators of a bullish reversal for DOGE, offering a glimmer of hope amidst the prevailing uncertainty.

As of press time, DOGE is trading at $0.1416 marking a marginal increase of 0.90% in the last 24 hours and a sharp decline of 9.96% in the last 7 days. These downward spirals reflect the broader bearish trend engulfing the cryptocurrency market, prompting concerns and caution among investors who brace for further turbulence.

Source: TradingView

Amidst the prevailing gloom, a potential silver lining emerges for DOGE, with the detection of a bullish pattern on its 6-hour chart. This pattern, if successfully realized, could herald a significant upswing in the coming days, enabling DOGE to not only recoup recent losses but also surpass previous highs, instilling renewed optimism among traders.

Source: TradingView

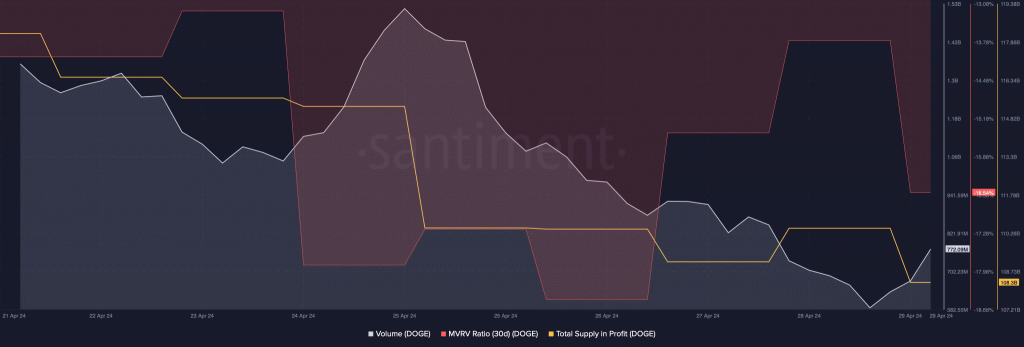

While recent market data suggests a resurgence in DOGE’s trading volume, this uptick occurs against the backdrop of declining prices, signaling potential challenges ahead. Moreover, the MVRV ratio, a crucial metric indicating investor profitability, has witnessed a sharp decline, reflecting a reduction in DOGE’s total supply of profit and highlighting prevailing market headwinds that DOGE must navigate.

Source: Chart by Santiment

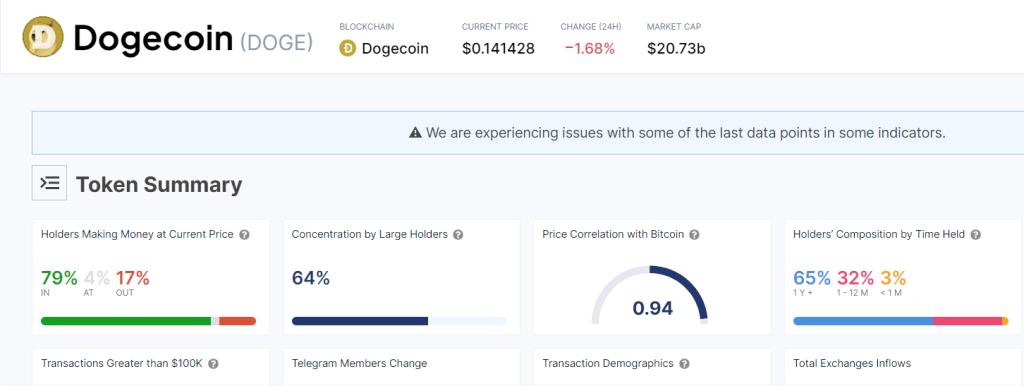

Insights from renowned analytical platform IntoTheBlock revealed that only 79% of DOGE investors currently find themselves in a profitable position, underscoring the pervasive bearish sentiment surrounding the coin. Social metrics further corroborate this narrative, with DOGE experiencing a decline in social value, indicating waning popularity within the crypto community.

Source: Image by IntoTheBlock

Market indicators paint a challenging picture for DOGE, with the MACD signaling a clear bearish bias and the Relative Strength Index (RSI) continuing its descent below the neutral mark. These indicators suggest the potential for further price declines before any meaningful recovery takes hold, adding to the uncertainty surrounding DOGE’s immediate future and exacerbating investors’ apprehension.

Source: TradingView

In light of these developments, the road ahead for Dogecoin appears fraught with uncertainty. While a bullish pattern offers a glimmer of hope, prevailing market indicators and sentiment suggest that DOGE may face further downward pressure before staging a potential recovery. Investors and enthusiasts prepare for a turbulent journey in the unpredictable world of Dogecoin.