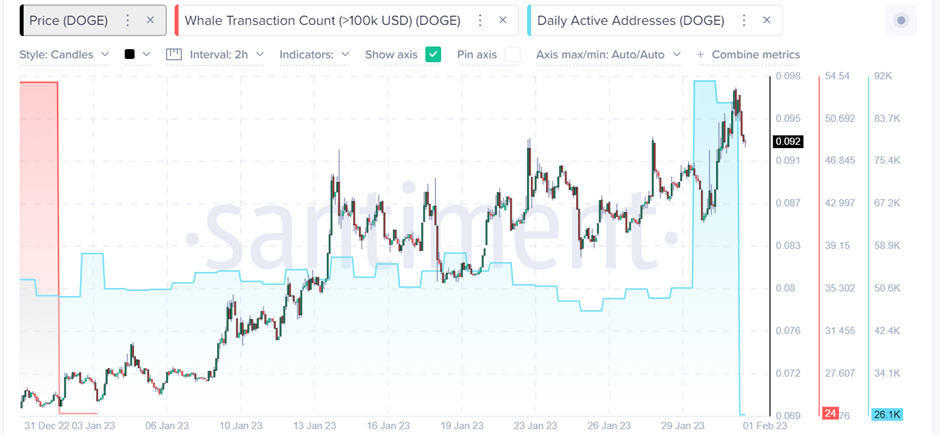

Dogecoin has broken out from its bearish trend over the past few weeks as it has gained +40% since December 29th, 2020. The price surge is backed by whale transactions and address activity spiking to their highest levels in the past two months. This surge in on-chain activity may indicate that a bull run is coming for Dogecoin, at least in the short term.

Whales have been taking advantage of this opportunity as many large transactions occurred today, easily the highest of the year. According to Dogecoin’s Twitter account,450,000,000 $DOGE ($40,536,900 USD) was transferred from a #Top20 wallet to an unknown wallet. This large transaction is likely to have further contributed to the increase in price.

Moreover, address activity has also spiked along with the surge in price. According to Santiment data, there are more than 86.4K active addresses for Dogecoin, the highest since November 2nd and 3rd.

Dogecoin has been a polarizing coin, with some analysts predicting it to reach as high as $1 in 2023, while others remain skeptical. Despite this bearish sentiment, Dogecoin has made impressive progress over the past month, and this on-chain activity may indicate further progress.

DOGE/USD Recent Technical Analysis

Dogecoin’s recent uptrend has pushed the coin to test resistance around $0.0955. The next major hurdle for Dogecoin would be to break above this level and find support at its 200 Simple Moving Average (SMA). If DOGE/USD can do that, there could be a significant surge in price.

On the other hand, if Dogecoin fails to break through this resistance level, it could lead to a pullback, with DOGE/USD dropping back below $0.074, which was its low for November 2022.

Dogecoin is maintaining its positive momentum over the last 30 days and is nearing 0.1120. We have gone past the White Demand Zone, which has been responsible for major buying prospects since June, and it looks like we will be able to break through 0.1120 after one more pullback from 1-day MA50. A minor breach of this level would result in a fast gap fill on the 0.1590 Resistance.

The popular technical indicators point to a bullish picture with the MACD entering a bullish zone and is supported by the RSI, which has already entered an overbought territory. The Stochastic RSI is residing in an overbought area, indicating a potential for a pullback in the short term.

Dogecoin is making impressive progress, and its on-chain activity indicates further growth in the short term. Whales are taking advantage of this opportunity as they transfer large amounts of Dogecoin to unknown wallets, while address activity is at its highest levels in two months.

If Dogecoin can break through resistance to find support at its 200 SMA, it could significantly surge in price. However, some key technical indicators still point to a potential pullback in the short term.