- Dogecoin’s recent price surge surpasses $0.082 resistance, eyes a 30% increase if $0.093 breached.

- However it clashes with a substantial drop in network activity.

- Over 60% addresses are in profit with large investors holding 43% of supply.

In a surprising turn of events, Dogecoin’s recent surge in price contradicts a substantial drop in network activity, as reported by data from IntoTheBlock. Despite this decline, the cryptocurrency’s market dynamics remain a focal point, with potential implications for investors.

Over the past week, Dogecoin’s network activity has experienced a noteworthy downturn, according to IntoTheBlock’s latest findings. While the price of the cryptocurrency has surged, the decline in network activity raises questions about the underlying market sentiment.

The daily chart for Dogecoin presents a bullish trend, having successfully surpassed the golden ratio resistance near $0.082. With the next significant Fibonacci resistance level at $0.093, a potential 30% price increase looms if this level is breached. Technical indicators, including the MACD histogram and Moving Average Convergence Divergence lines, support this optimistic outlook. However, caution is advised, as the Relative Strength Index suggests a possible corrective movement.

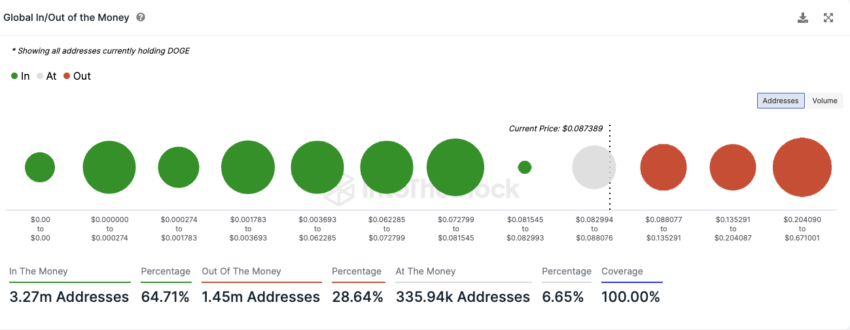

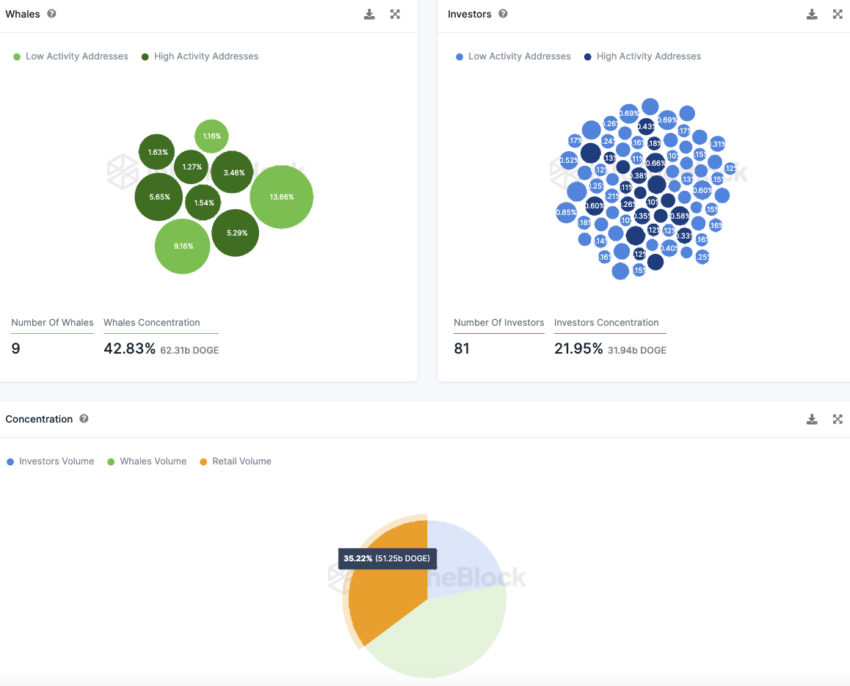

A positive trend emerges as over 60% of Dogecoin addresses currently find themselves in profitable positions. This statistic mirrors recent market performance and price fluctuations. Notably, the concentration of ownership lies with large investors and whales, with nine addresses holding a substantial 43% of the total supply.

Despite a recent increase in Dogecoin addresses, the past week has witnessed a significant decline in network activity. More than a 51% reduction in active addresses and a 67% decrease in creating new addresses point to decreased participation and interest. This decline is further accentuated by a 16% drop in addresses without any DOGE balances, indicating a phase of decreased activity within the Dogecoin ecosystem.

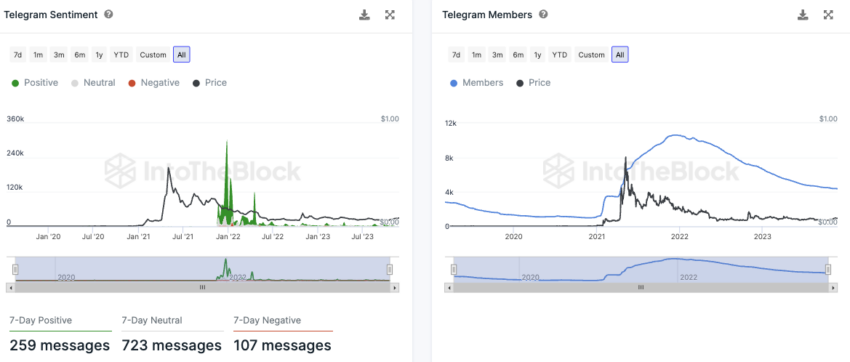

On Telegram channels, positive news stories about Dogecoin outnumber negative ones by a considerable margin. However, despite the favorable sentiment, the Dogecoin Telegram group has experienced a decline in membership since the end of 2021, possibly signaling a broader shift in community interest or information-sharing habits.

A significant aspect of Dogecoin’s ownership structure is revealed in the concentration among large investors and whales. Approximately 43% of the total supply is held by nine whale addresses, emphasizing the influence of a small group. In contrast, over one-third of Dogecoin’s supply is in the hands of retail investors, representing a broader base of smaller-scale holders.

In a recent update, Dogecoin (DOGE) stirred renewed interest among investors and enthusiasts. Concerns were triggered by reports uncovering a concerning pattern on the Dogecoin chart. The revelation left the cryptocurrency community in suspense, contemplating the potential implications this pattern could have on its future.