- dYdX holders nervously observe a spike in whale transactions ahead of the November 21 unlock event, sparking speculation about a potential asset value decline.

- Santiment data reveals a positive surge in active addresses, trade volume, and network growth for dYdX, historically aligning with upward price movements.

- The upcoming token unlock, and whale distribution raise uncertainty about the cryptocurrency’s future within the dYdX community.

In anticipation of the impending dYdX token unlock event scheduled for November 21, holders of the governance token are closely monitoring the surge in whale activity. Crypto enthusiasts are conjecturing whether heightened transactions from substantial holders could lead to a decline in the asset’s value.

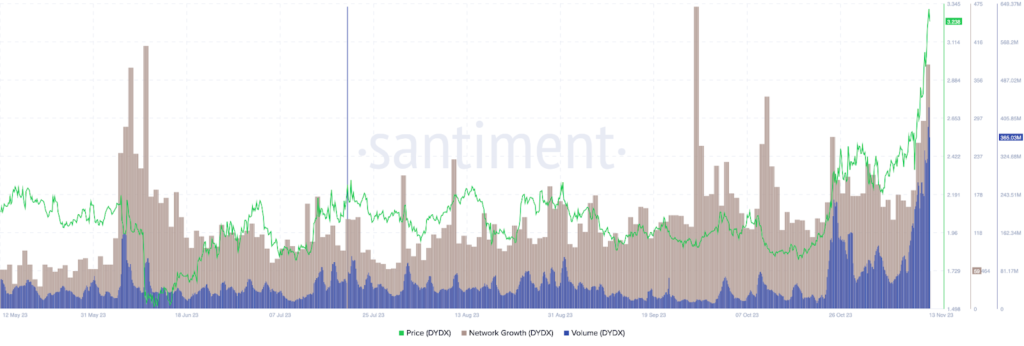

Data from the crypto intelligence tracker Santiment reveals a notable uptick in dYdX active addresses and trade volume, accompanied by a surge in Network Growth. These metrics, crucial indicators of market participant activity, historically correlate with upward price movements. The prevailing data supports an optimistic outlook for the governance token.

Adding to the positive sentiment is the Network Realized Profit/Loss (NPL) analysis, which exhibited a substantial spike on November 7. This surge suggests many traders realized losses and divested their dYdX token holdings. When coupled with the absence of active profit-taking by whales, the NPL metric leans towards a bullish scenario for the dYdX price.

Despite positive short-term indicators, the imminent token unlock event is causing apprehension among investors. Data from Token.unlocks.app indicated that on November 21, 2.16 million tokens, valued at $6.69 million, are set to enter circulation. With an additional 6.87 million dYdX tokens flooding exchanges in the last two weeks, there are indications of a possible correction in the token’s market value.

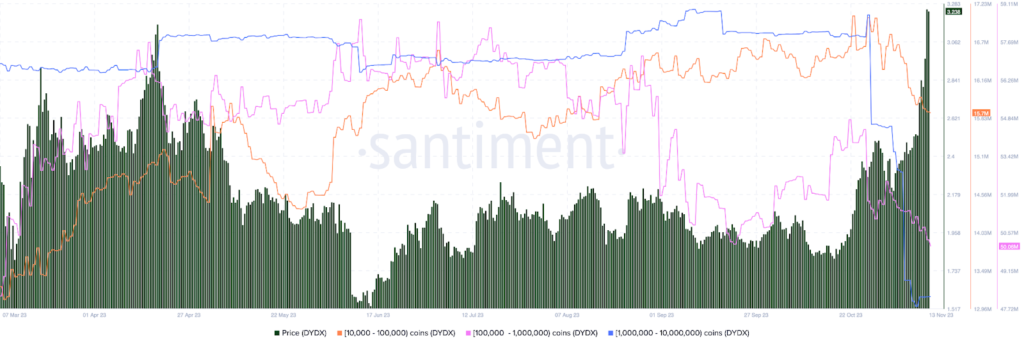

The crypto market is preparing for a potential surge in selling pressure as significant holders, particularly across three tiers with holdings ranging from 10,000 to 10 million dYdX tokens, actively unload their positions, injecting an element of uncertainty into the cryptocurrency’s long-term price path.

While short-term gains for dYdX seem promising based on current metrics, the shadow of the November 21 unlock event, and ongoing whale distribution cast a bearish hue on the token’s future. The community is on high alert, conscious that the unlock event could catalyze a significant downturn in the asset’s price, emphasizing the volatile nature of the cryptocurrency market.