- Surge in Bitcoin ETF inflows signals strong investor confidence, with The Nine & Blackrock leading the charge.

- GBTC’s $175M outflow raises eyebrows, hinting at possible market shifts post-judicial decisions.

- Bitwise hits record volume, highlighting growing interest in diversified crypto investments.

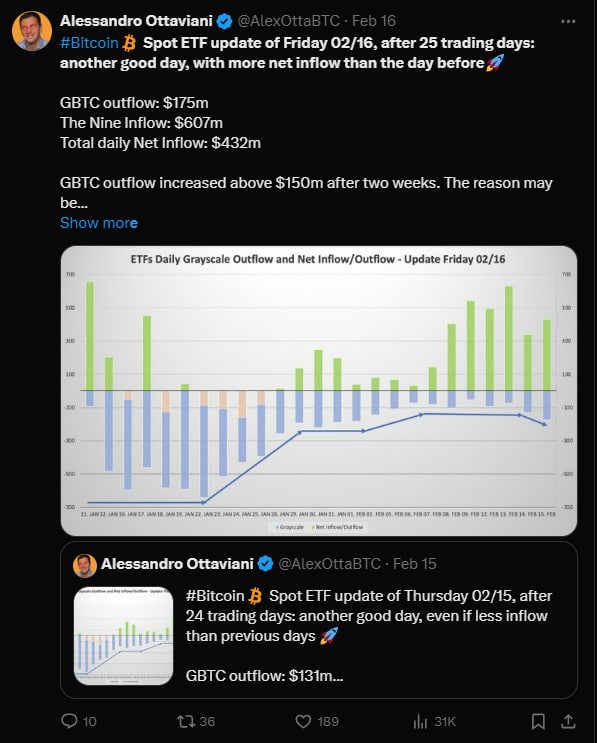

The recent trading activities have spotlighted significant movements within Bitcoin Spot Exchange-Traded Funds (ETFs). As per Alessandro Ottaviani, a prominent blockchain figure, over the past 25 trading days, a notable surge in ETFs’ net inflows has indicated a bullish sentiment among investors. Particularly, the spotlight has been on the increased activity involving Grayscale Bitcoin Trust (GBTC) and The Nine, alongside remarkable performances by Blackrock and Bitwise in the ETF domain.

Significantly, GBTC experienced an outflow of $175 million, a substantial increase above the $150 million threshold after a two-week lull. This uptick might be attributed to the actions of major stakeholders like Genesis, DCG, and Gemini, potentially in response to recent judicial decisions. However, concrete evidence linking these sales directly to the court’s approval remains speculative.

On the other hand, The Nine reported a robust inflow amounting to $607 million, maintaining its strong momentum with inflows surpassing the $600 million mark. This influx underscores the growing investor confidence in The Nine’s offerings.

Moreover, BlackRock has continued its upward trajectory with an inflow of $331 million, reinforcing its stature in the ETF landscape. Bitwise, not to be outdone, celebrated its most successful day in terms of volume since its inception, alongside a significant $127 million inflow, marking its second-highest inflow day.

As further highlighted by Alessandro Ottaviani, the ETF volume results from the 25th trading day, with IBIT leading at $665 million, followed closely by GBTC at $626 million and FBTC at $370 million. The volume for The Nine approached an impressive $1.4 billion, indicating a vibrant trading environment.

Despite the fluctuations in volumes for IBIT and FBTC, GBTC maintained a steady volume. The dispatch of 2,400 BTC to Coinbase by GBTC hints at a potential decrease in inflow to below $300 million, a situation that merits close observation in the coming days.

Hence, the cryptocurrency ETF market is witnessing a phase of vigorous activity and investor interest. These developments reflect the market dynamics and hint at the evolving strategies of key players within the ETF ecosystem.