- Crypto Tony signals a potential rebound for Ethereum from the $2,100 support level, following a downturn triggered by resistance at $2.6K.

- Ethereum’s daily chart analysis reveals a 20% decline after a notable rejection at the $2.6K resistance, breaking through critical support zones.

- Positive funding rates offset the decline in open interest in the futures market, hinting at a potential bullish sentiment once the correction phase concludes.

In a pivotal move, renowned crypto analyst Crypto Tony has recently shared insights on Ethereum’s current market situation in an X post, pointing to a potential bounce from the $2,100 support level. After grappling with resistance at $2.6K, the cryptocurrency experienced a substantial downturn, breaching critical support levels.

Ethereum’s daily chart analysis reveals a noteworthy rejection at the $2.6K resistance, resulting in a 20% decline. The price also broke through key support zones, including the upper boundary of a multi-month ascending wedge and the lower boundary of a short-term expanding wedge, indicating prevalent selling pressure in the market. A significant bearish divergence between the price and the RSI indicator on the daily chart further emphasizes the negative sentiment, acting as a catalyst for the downward momentum.

Ethereum is trading at $2,209, showcasing a 0.71% decline in the last 24 hours and a more substantial 11.07% decrease over the past 7 days. The 24-hour trading volume, a key metric indicating market activity, is a substantial $9,516,904,374.

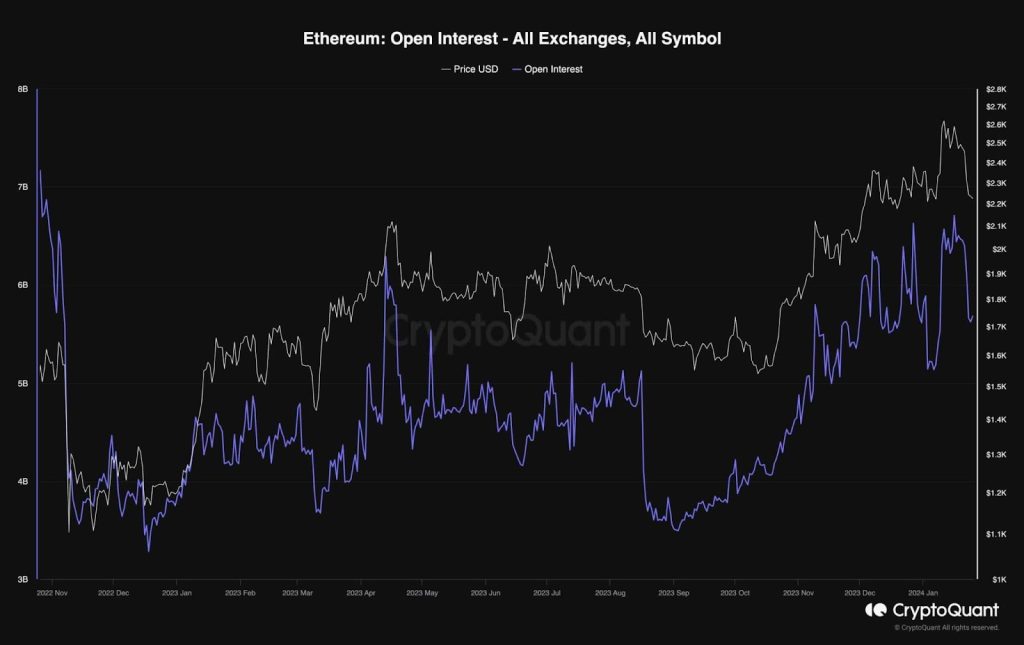

A noteworthy signal emerges from the futures market dynamics amid the decline in Ethereum’s value. According to the on-chain analytical platform Crypto Quant, open interest, a pivotal metric for assessing sentiment in the futures market, has experienced a significant decline. Open interest gauges the number of active futures positions, and lower values typically correlate with decreased volatility.

However, the positive funding rates indicate that the overall sentiment towards Ethereum is still bullish. This suggests that the perpetual markets are cooling down from their previously overheated state. Many analysts believe that once the current correction phase ends, the price of Ethereum could potentially resume its upward trajectory. Traders and investors closely monitor these key indicators as Ethereum undergoes a critical phase in its market journey.