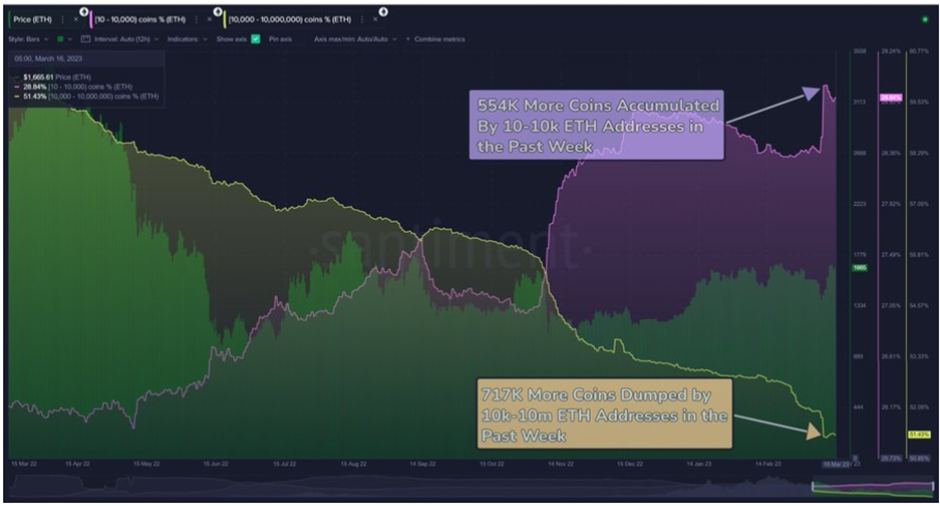

The recent data by Sentiment reveals a significant shift in Ethereum’s supply distribution as large addresses holding 10-10K $ETH collectively added 3.61M coins over the past year. However, in the same timeframe, addresses with 10K-10M $ETH collectively dumped 9.43M coins, indicating a decline in whale holdings.

These trends suggest that Ethereum Sharks are accumulating ETH while Whales are decreasing their holdings. This information may have implications for the overall market sentiment toward Ethereum and could impact its price.

Ethereum price analysis: Recent developments and technical analysis

The highly anticipated Shanghai hard fork on Ethereum has been scheduled for April 12, marking a significant step towards the completion of Ethereum’s transition to a proof-of-stake (PoS) consensus.

The upgrade will introduce five Ethereum Improvement Proposals, including EIP-4985, which will enable staked Ether withdrawals on the Beacon Chain, providing stakers with the ability to exit positions entirely and reclaim their full balance. This feature will help complete Ethereum’s transition from proof-of-work to a PoS consensus, which has been a long-awaited event in the crypto world.

Initially planned for March, the fork was pushed back to April to ensure adequate time for development and testing. Ethereum core developers approved the deadline during the All Core Developers Execution Layer #157 call on March 16. The target date of April 12 at 10:27:35 pm UTC, epoch 620,9536, will be confirmed by developers on GitHub.

The Ethereum PoS smart contract has already attracted over 17.6 million ETH, valued at nearly $29.4 billion at publication time, according to Etherscan. This indicates that investors and stakers are eagerly anticipating the upgrade. However, some analysts have warned that the upgrade could trigger a sell-off in the short term.

Once the upgrade is complete, validators will receive rewards payments automatically at periodic intervals in withdrawal addresses, making it easier for stakers to earn rewards. Overall, the Shanghai hard fork is a significant milestone for Ethereum, and the crypto community is eagerly anticipating its completion.

Ethereum is trading at $1,718.95, up by over 4% in the last 24 hours, and technical analysis suggests that a further upswing is likely. The Relative Strength Index (RSI) on the daily chart indicates an overextended market, which could mean that a price correction is imminent. Ethereum has recently broken out of an ascending triangle pattern, indicating an upside move.

A breakout above $1,850 could confirm the uptrend, while on the downside, a break below $1,650 could spark a deeper correction. If Ethereum manages to stay above $1,650 and maintain its upward momentum, we can expect it to reach highs of around $2,000 or higher in the near future.