- Ethereum faces crucial support at $3,644 and $3,579 with resistance at $3,931 and $3,989 amidst significant volatility.

- Ethereum futures funding rates indicate a bearish sentiment, indicating potential price decline.

- Market analysts suggest cautious optimism, emphasizing calculated risk-taking in a volatile market, highlighting buying opportunities.

Ethereum recently finds itself at a crossroads, displaying significant volatility that has captured the attention of investors. The current technical analysis and fluctuations in Ethereum’s futures funding rates present a complex tableau of potential risks and opportunities. Ethereum as the second-largest cryptocurrency by market capitalization teeters near crucial support levels.

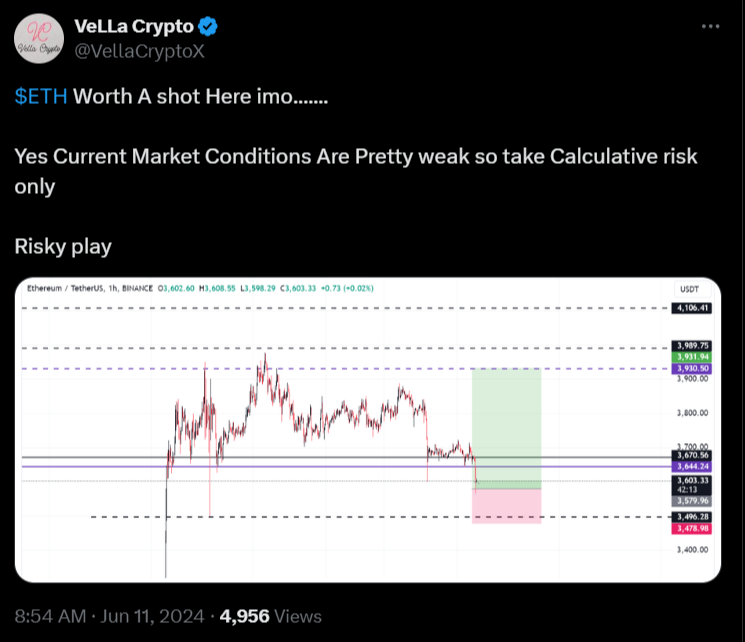

Key support and resistance levels have been identified that could dictate short-term market movements. At the moment of writing, Ethereum is hovering around an initial support level at approximately $3,644, with a more significant support zone around $3,579. In case these levels are broken down, the price may continue falling down to the next level of support at $3,496 or even the strong support at $3,479. On the flip side, the resistance levels at $3,931 and $3,989 present significant obstacles to further increase.

Parallel to the price action, the Ethereum futures perpetual funding rate shows significant volatility. This metric that depicts the cost of holding futures contracts has of late been slightly neutral to slightly negative. Such rates are usually considered as bearish signals, which may imply the traders’ expectation of the price decrease.

Analyst Predicts Ethereum’s 13x Surge Based on Previous Cycle PatternsInsights from a market analyst further enrich this analysis. VeLLa Crypto suggests that while Ethereum may currently present a buying opportunity at these levels, the overall market weakness cannot be ignored. This advice points to the necessity for calculated risk-taking in an environment where certainty remains elusive.

The current market setup might offer opportunities, although with associated risks. The advice from seasoned traders leans towards calculated and well-informed trading decisions, especially when operating close to critical support zones. The market’s potential to pivot around these levels could lead to significant price movements, warranting a vigilant and prepared trading strategy.

The Ethereum market is displaying signs of both opportunity and caution. The proximity to critical support levels combined with the bearish funding rates paints a picture of a market teetering on the edge.