- Ethereum’s rise over $2K, driven by BlackRock’s ETF interest, highlights its growing market dominance.

- ETH’s reversal against BTC and robust market indicators suggest a bullish trend.

- Despite potential consolidation near $2K, Ethereum’s price above key EMAs signals strong upward momentum.

Ethereum (ETH), a major player in the cryptocurrency market, recently marked a significant achievement by crossing the $2,000 threshold. As highlighted by Kaiko, a prominent blockchain figure, this milestone, the first since April, comes in the wake of BlackRock filing for a spot Exchange-Traded Fund (ETF).

The current live price of Ethereum stands at $2,056.70, with a market cap of $247.34 billion USD and a 24-hour trading volume of $9.48 billion USD. These figures demonstrate Ethereum’s robust presence in the digital currency landscape.

Notably, the ETH/BTC ratio has reversed its year-long downward trend, underscoring Ethereum’s strengthening position against Bitcoin. This shift indicates a dominant buying force in the market, propelling Ethereum’s price into an upward trajectory. However, this ascent has led to Ethereum approaching a crucial resistance level at $2K, suggesting the potential for a temporary consolidation phase.

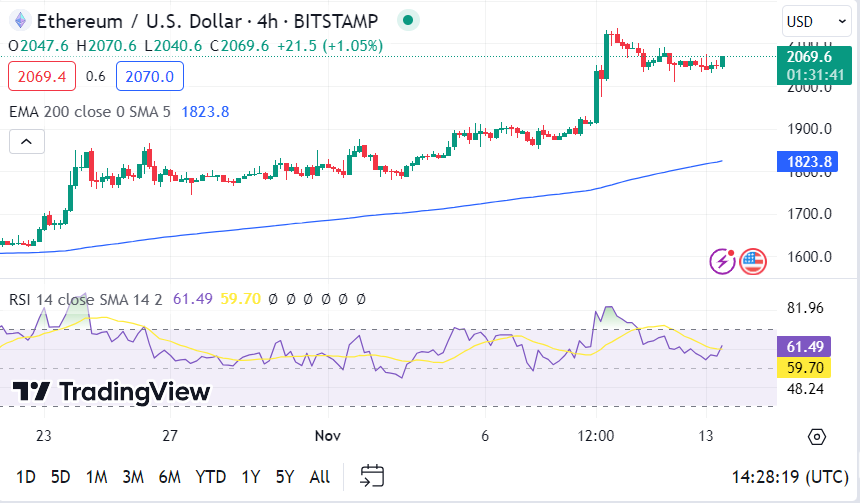

Moreover, the 4-hour Relative Strength Index (RSI) for Ethereum reads 56.54, signaling moderate upward momentum. This is corroborated by the asset’s position relative to its Bollinger Bands: the upper band sits at 2093.7, indicating an approaching resistance level, while the lower band at 2028.7 provides a support level, suggesting limited downside potential.

Additionally, Ethereum’s current price is above its 50-day Exponential Moving Average (EMA) of 1988.3, indicating a bullish trend. This trend is further supported by the asset’s position above its 100-day EMA of 1913.4 and 200-day EMA of 1823.7. The gap between Ethereum’s price and its 200 EMA underscores the strength of the bullish sentiment in the market.

Ethereum’s recent rally to over $2,000 marks a significant development in the cryptocurrency sector, bolstered by growing institutional interest and positive market indicators. While a consolidation phase may be imminent around the $2K resistance level, the overall market indicators remain bullish. As Ethereum continues its upward trajectory, closely monitoring these indicators will be crucial for understanding future market movements.