- Over half of 2023 Ethereum tokens were flagged for manipulation, but only 1.3% impact on DEX volume.

- On-chain analysis reveals that 54% of tokens met manipulation criteria, emphasizing potential DeFi risks.

- Chainalysis report underscores limitations of on-chain data, urging vigilance against manipulative practices in DeFi.

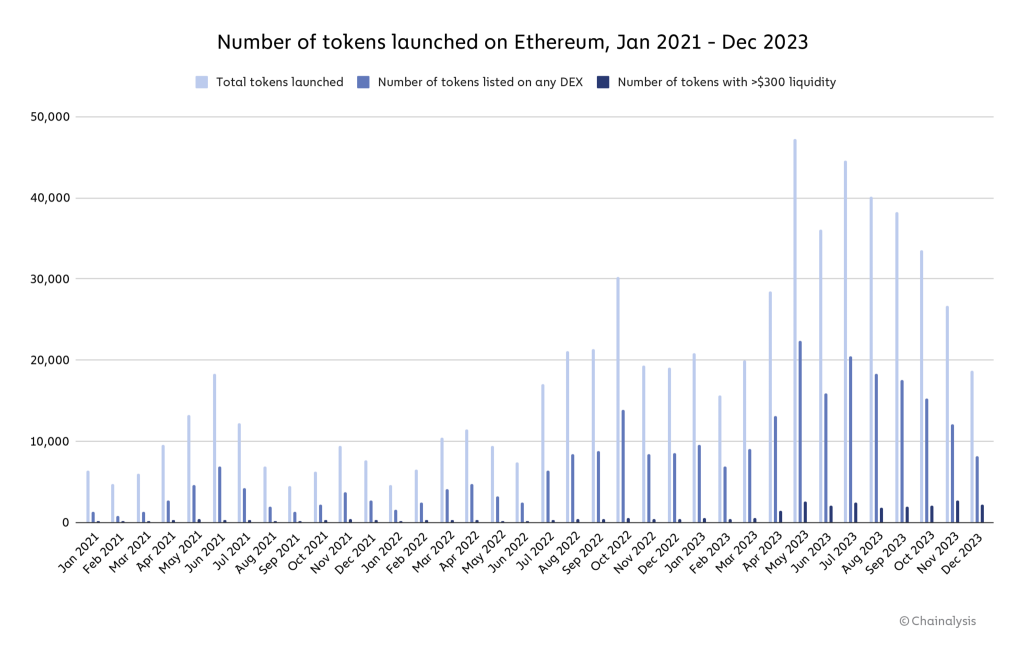

A new report by Chainalysis paints a nuanced picture, revealing that while over half of new Ethereum tokens launched in 2023 displayed red flags for manipulation, their collective impact on the total trading volume was negligible. The study employed an on-chain analysis methodology to identify suspicious patterns.

Tokens meeting specific criteria, such as large holder dumps, low post-dump liquidity, and minimal pre-dump purchases on decentralized exchanges (DEXes), were flagged for further investigation. The findings are startling: over 90,400 tokens, representing a staggering 54% of all tokens launched on Ethereum DEXes in 2023, met these criteria. This suggests a pervasive culture of potentially manipulative token launches within the DeFi ecosystem.

Source: Chainalysis

These flagged tokens, despite their abundance, collectively accounted for a mere 1.3% of the total DEX trading volume in 2023. This means that while the potential for manipulation exists, its actual impact on the broader market appears minimal. The vast majority of these tokens likely fizzled out, failing to attract significant trading activity and leaving minimal impact on unsuspecting investors.

The report emphasizes that these findings alone cannot definitively confirm pump and dump schemes. On-chain data, while valuable, lacks the context to paint the full picture. Off-chain evidence, such as social media marketing and communication patterns, is often required to solidify suspicions and pinpoint culprits. This highlights the limitations of solely relying on on-chain analysis for regulatory efforts.

However, the Chainalysis report has the case study of one prolific actor who launched a whopping 81 tokens meeting the criteria, amassing an estimated $830,000 in profits, raising concerns about repeat offenders exploiting the system. The detailed breakdown of this actor’s tactics, involving wash trading, liquidity pool manipulation, and potential rug pulls, serves as a chilling reminder of the potential harm these schemes can inflict.

Though the DeFi landscape offers exciting opportunities, it remains susceptible to manipulation. While the overall impact of flagged tokens in 2023 was minimal, the sheer number raises concerns and demands vigilance.

Ethereum’s climb to $2,345, its highest point since January 22, signifies a noteworthy achievement. Santiment’s analysis links this rise to a surge in active addresses and overall network expansion, highlighting Ethereum’s increasing utility and growing market capitalization.