- Glassnode insights exposed the nature of Bitcoin’s rollercoaster ride in the past 24 hours.

- SEC Twitter hack triggers $2B Bitcoin flood and $750M worth of losses, market upheaval.

- Reportedly, over $1.3B bitcoins were moved to exchanges as short-term BTC holders navigated volatility.

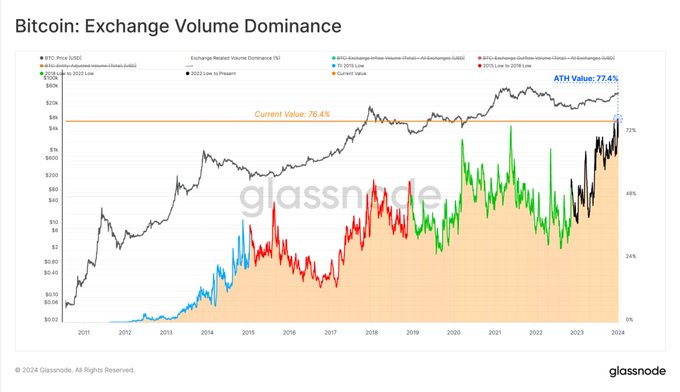

In the eye of the recent storm surrounding Bitcoin, Glassnode’s latest report unveils a market landscape marked by intensified exchange activity. A staggering 76.4% of Bitcoin’s on-chain volume is coursing through exchanges, teetering just below the all-time high of 77.4%.

The surge in exchange activity is mainly driven by the recent compromise of the SEC’s Twitter/X account. The account breach disseminated false news of Bitcoin ETF approval, triggering market reactions. Bitcoin initially surged to approximately $48,000, only to nosedive to $44,900 swiftly afterward. The ensuing turbulence prompted the liquidation of both short and long positions.

Adding to the complexity of the situation, short-term Bitcoin holders, those with holdings of less than 155 days, mobilized a considerable amount of their profits. An astounding $1.3 billion was sent to exchanges, marking one of the most substantial profit transfer days in the past two years.

The broader impact of this flurry of activity becomes evident when examining the total inflow to exchanges, which reached an astronomical $2 billion worth of Bitcoin. This magnitude has been witnessed only thrice before in the annals of Bitcoin’s history. However, the joy of these transfers was marred by the stark reality that a considerable chunk—$750 million, to be precise—was sent at a loss.

The severity of the market upheaval triggered by the false ETF approval news is underscored by these losses. Responding to the misleading information, investors engaged in a frenzied dance that left a substantial portion counting the costs of their actions.

Yesterday, the crypto market was immersed in discussions about the surge in Bitcoin’s value due to expectations of the approval of a Bitcoin exchange-traded fund (ETF). However, Mike McGlone, a senior macro strategist at Bloomberg Intelligence, warned about a potential downturn for the leading cryptocurrency.

In a recent conversation with crypto influencer Scott Melker, McGlone expressed apprehension about the historical tendency of risk assets, including Bitcoin, to face a downturn following significant rallies. He pointed out past events, such as the fall of Lehman Brothers and the collapse of FTX, to highlight the inherent risk associated with Bitcoin’s current market position.