Data gathered by blockchain analytics firm Kaiko Research revealed that nearly three-quarters of Ether liquidity is concentrated on five mainstream crypto exchanges namely Coinbase, Binance, Kraken, OKX, and Bitfinex. The concentration increased drastically after the collapse of the once-prominent crypto exchange FTX, which accounted for nearly 40% of ETH market depth before its downfall in November last year.

The Kaiko Research Team recently published a report that took a closer look at Ether’s liquidity and market depth in the aftermath of FTX’s collapse. According to the Research Team, there had been little good news on the liquidity front for most crypto assets since Sam Bankman-Fried’s crypto exchange went down.

The 2% market depth for ETH revealed that liquidity had failed to revolver to pre-FTX levels ever since it dipped below the $100 million mark in March this year. However, 0.1% depth, which measured the liquidity in proximity to the mid-price, had recovered above pre-FTX levels indicating that market makers were comfortable offering liquidity again around a tight range.

The Kaiko Research Team found that order book liquidity has become very concentrated on a small group of major crypto exchanges. These exchanges accounted for a whopping 72% of ETH’s liquidity, with the rest 28% shared by 41 other crypto exchanges. Kaiko predicted that such consolidation of liquidity could be expected for all assets given that the bear market is keeping market makers away from exchanges.

In addition to becoming concentrated across a handful of exchanges, liquidity had also moved away from the United States over the past year. The share of market depth on U.S.-based exchanges went from 54% to 40% following Terra’s collapse in May 2022. Crypto exchanges around the world benefited from the regulatory crackdown on crypto entities in the United States.

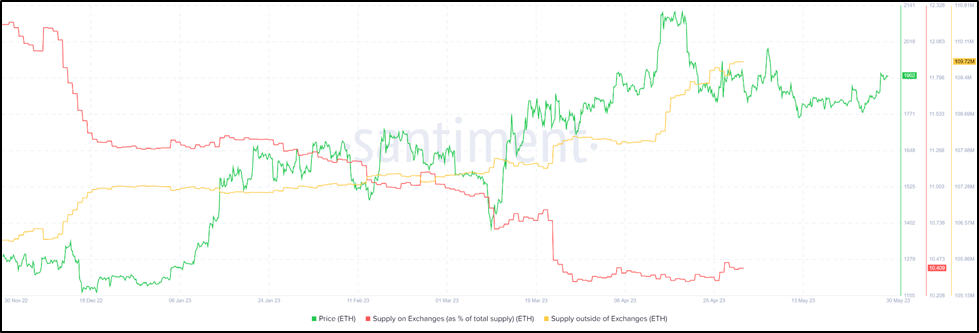

Data from Santiment showed that Ether’s supply on crypto exchanges declined considerably in the aftermath of FTX’s collapse in November 2022. The supply went from 12% of the total supply to 10%. Meanwhile, the supply of ETH outside of exchanges went from 106 million in November 2022 to almost 110 million as of April 30, 2023.