- FTX Estate’s SOL transactions, involving substantial asset shifts to unknown wallets, ignite market intrigue and strategic speculation within the cryptocurrency sphere.

- Solana’s market performance and price volatility were highlighted by major sol transfers, impacting investor sentiment and trading volume in the digital currency landscape.

- Cryptocurrency asset management dynamics are reflected in FTX Estate’s Solana transfers, with technical indicators showing neutral trends and potential for future price movements.

The FTX Estate account has been involved in a substantial cryptocurrency transaction, marking a notable event in the digital currency landscape. A whopping 197,694 SOL, equivalent to approximately 14,669,449 USD, was moved from the FTX Estate’s holdings to an unidentified digital wallet. This transfer signifies a major asset shift within the cryptocurrency sphere, sparking interest and speculation among investors and market analysts.

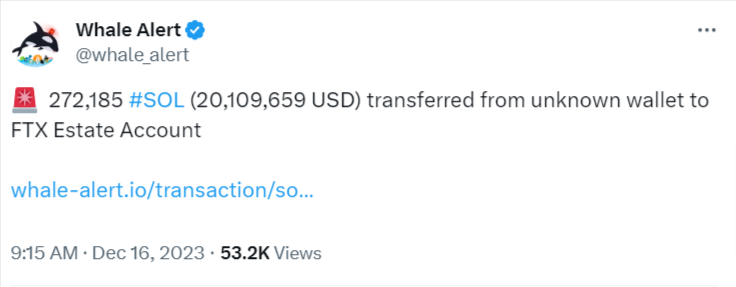

Whale Alert, an advanced blockchain tracker and analytics system, reported large transactions of SOL. It shared an X post, providing the current details of these significant movements involving the FTX Estate.

Following this significant outflow, there was a notable reverse transaction. An unknown wallet transferred an even larger amount of Solana – 272,185 SOL, valued at around 20,109,659 USD, back into the FTX Estate account. This activity indicates a dynamic and possibly strategic movement of funds within the cryptocurrency market, particularly involving the FTX Estate.

The FTX Estate’s involvement in these transactions is particularly noteworthy given its status and influence in the digital currency. The transfer to an unknown wallet raises questions about the strategic intentions behind these moves. At the same time, the subsequent influx of a larger amount of Solana underscores the complex and often unpredictable nature of cryptocurrency trading and asset management.

Over the past week, Solana has shown impressive growth and stability in the market, making it a popular choice among investors and traders. SOL has been trading above $70.00, with bullish predictions suggesting it could reach $80.00 in the near term if this trend continues. However, if bears take over, it could fall back down to $50.00 or lower.

Solana’s price is currently $74.06, with a slight decrease of 2.56% in the past 24 hours. The current market capitalisation is $31,664,716,124, ranking Solana as the seventh-largest cryptocurrency by market cap. The trading volume in the last 24 hours has been $2,517,706,775, indicating strong activity and interest in SOL.

The technical indicators for Solana are in neutral territory, with moving averages showing a slight bearish trend. The Relative Strength Index (RSI) is at 63, suggesting there is room for price movement in either direction. The moving average convergence/divergence (MACD) is slightly above the signal line, indicating a possible continuation of bullish momentum. The current price is above the 50-day and 200-day moving averages, which could signal a bullish trend in the long term.