- Recent outflows from U.S. BTC ETFs coincide with Bitcoin’s price dip below average buying price.

- Grayscale’s GBTC reverses outflow trend, indicating a potential turnaround in Bitcoin ETF fortunes.

- Market resilience is demonstrated by continued net inflows and revived investor interest in Bitcoin-related assets.

Bitcoin exchange-traded funds (ETFs) have garnered considerable attention, especially after witnessing notable outflows from newly established U.S. BTC ETFs. However, recent events suggest a possible shift in fortunes, as Grayscale’s GBTC halts its outflow and begins to attract inflows. This change in sentiment prompts inquiries about the future path of Bitcoin ETFs.

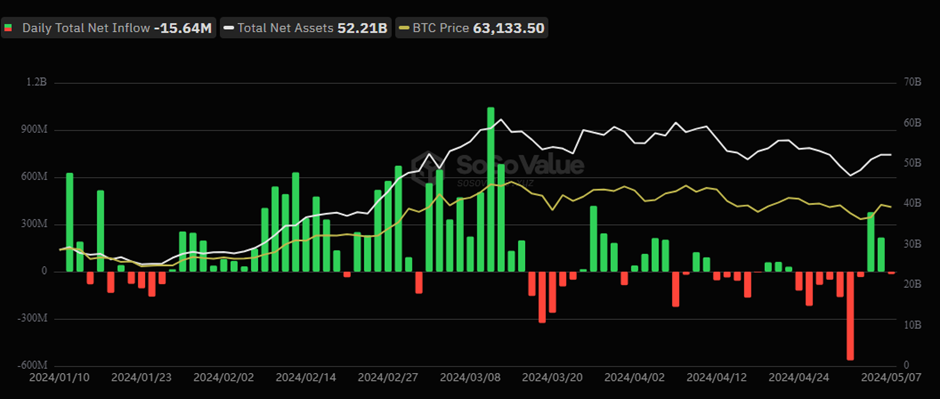

Last week, U.S. BTC ETFs faced substantial outflows amounting to $156 million, coinciding with a dip in Bitcoin’s price below the average buying price of the ETF issuers. The CoinShares report suggested that automatic sell orders triggered by a 10% drop below the average purchase price could have contributed to this drawdown. This decline was exacerbated by BTC’s plunge to $56.5K on May Day, resulting in widespread liquidations and market turbulence.

Despite facing initial challenges, the market has shown resilience, with Grayscale’s GBTC surprising analysts by reversing its outflow trend. On Friday, it received inflows of $63.9 million, followed by an additional $3.9 million on Monday. Bloomberg analyst Eric Balchunas attributes this turnaround to Grayscale’s strong marketing efforts and the rebound in Bitcoin’s price, which has discouraged investors from pulling out.

Beyond Grayscale, the market’s upbeat trend continues, with total net inflows reaching $378.2 million on Friday across different Bitcoin investment vehicles. Additionally, U.S. BTC ETFs remained profitable on Monday, attracting an extra $217 million in net inflows. These occurrences highlight a revived interest among investors in Bitcoin-related assets, driven by the cryptocurrency’s bounce back from recent declines.

As Bitcoin regains ground and approaches its previous price consolidation range of $60K to $71K, there is optimism that U.S. BTC ETFs could reverse last week’s outflows. However, market dynamics remain fluid, and future performance hinges on factors such as regulatory developments, institutional interest, and broader market sentiment.