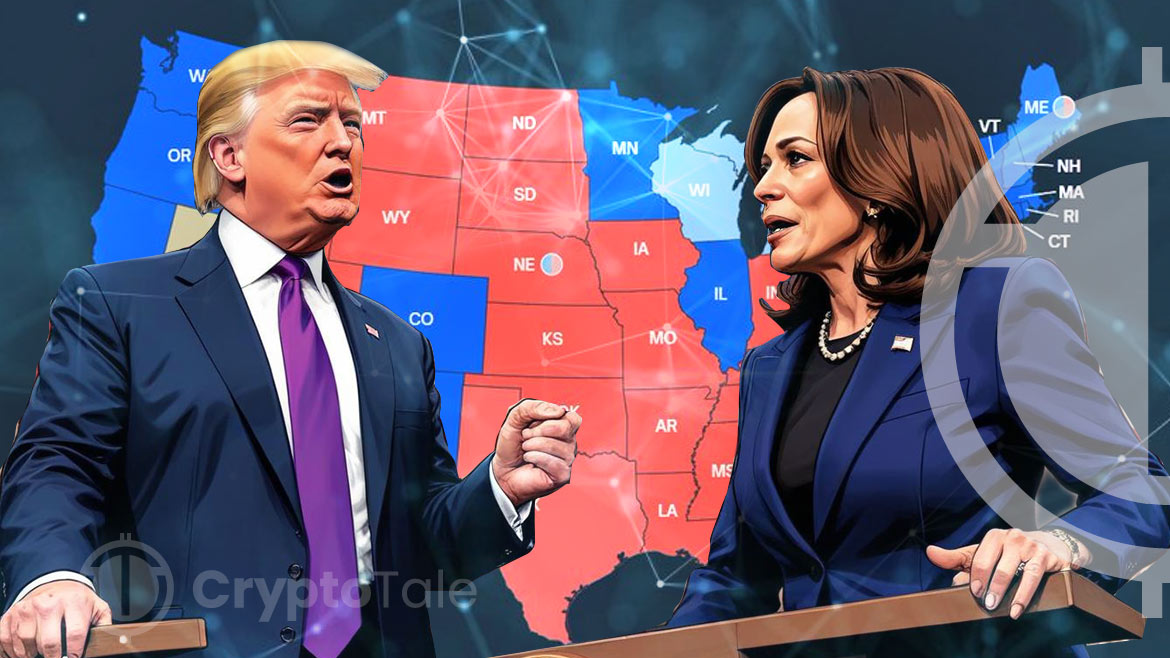

Vice President Kamala Harris performed better than former President Donald Trump in the latest U.S. presidential debate. This caused a stir in political betting and cryptocurrency markets. Bitcoin’s value decreased and betting odds shifted in favor of Harris as the candidates traded insults.

Debate Impact on Markets

The aftermath of the debate was showcased in a more than 2% decrease for Bitcoin tumbling to $56,300. The decline was in line with broader market worries about what U.S. policy may be like going forward. Other major cryptocurrencies, such as Dogecoin, also decreased, with it down 4% in the same timeframe. Additionally, the perceived probability of Harris winning the election rose in political betting markets — which is evidence of her having won, at the very least, this virtual tussle.

Influenced by the election debate, the Japanese yen, known as a safe-haven currency, strengthened to 140.70 per U.S. dollar, its highest level since January. This marks an appreciation beyond the 141.68 level seen in early August.

Political Figures and Crypto Policies

Political talk in the crypto world continues, even as the market morphs. All the while, Ripple CLO Stuart Alderoty was busy getting attention of his own. He called on Vice President Harris to reduce the SEC’s wave of tight restrictions against cryptocurrencies. This is seen as part of a broader appeal by the crypto industry for more supportive legislation. According to Alderoty it is essential for industry innovation and growth.

Harris Eyes Gensler for Treasury, Sparking Crypto DebateRipple’s Political Endorsements and Implications

Ripple co-founder Chris Larsen endorsed Harris in a public statement. He showed strong support from the tech and crypto sectors. The endorsement aligns with Harris’ potential policy shifts. These shifts could benefit the crypto industry as echoed by industry leaders seeking a more favorable regulatory environment.

In previous reports, Donald Trump had a slight lead in Polymarket’s election odds. It reflected a changing political influence by public perceptions and rumored policies. An instance of that is the speculated unrealized gains tax linked to Harris. As reported earlier, these speculations have sparked significant discussions in the financial and crypto communities.