Cryptocurrencies that are pegged to the dollar are popularly known as Stablecoins. The prominent feature is that the value of the stablecoins is less volatile than a compared crypto asset like Bitcoin and Ethereum.

Further, stablecoins can be categorized in two ways- one which is centrally controlled by a company. Another, is decentralized, algorithmic stablecoin. Top stablecoins as per the market cap are Tether (USDT), USD Coin (USDC), Binance USD (BUSD), Dai (DAI), and Pax Dollar (USDP)

In addition, these coins give instant access to the investor’s portfolios as dollar value held in stablecoins.

Stablecoins have seen exponential growth over the past two years. However, the total supply of stablecoins has decreased globally by 18.8% at the end of Q2 2022 mainly due to the volatile equity market as the concerns over rising inflation and other macro reasons hit the market sentiment.

As per the on-chain analytic firm Santiment, stablecoin holdings between $100,000 and $10 million are rising exponentially along with Bitcoin.

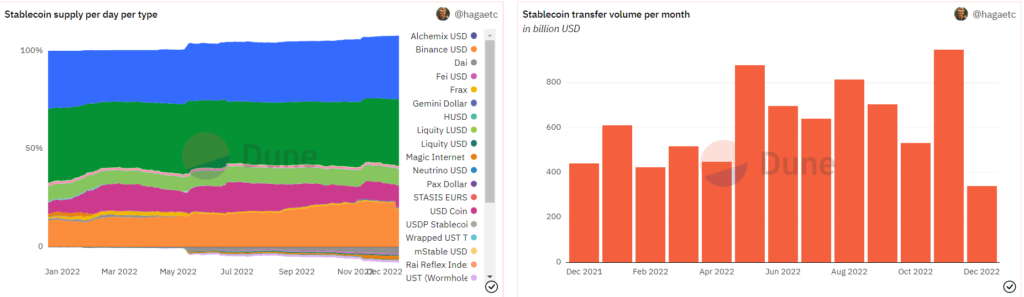

As in the above graph Tether, USD Circle, Binance USD, USD Coin, and DAI Maker DAO has been the top-performing stablecoins in 2022. The total transfer value hit its highest in the month of November at $800 billion.

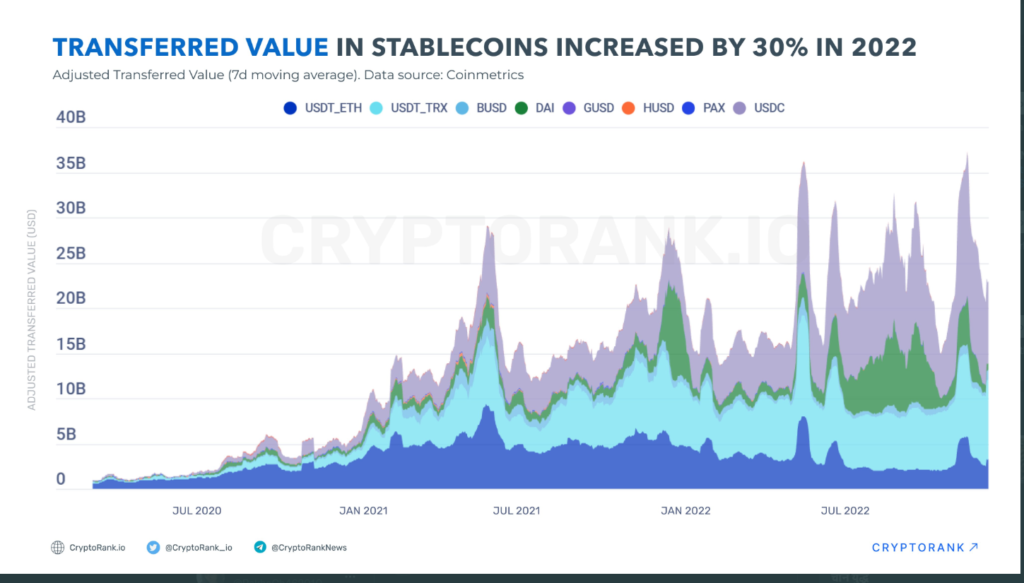

On the other hand, the overall transferred value increased by 30% in 2022 as per Cryptorank.

What does this growth mean?

This shows the confidence of holders in stablecoins has been growing at a rapid pace. These coins are considered a better alternative to traditional banking and a possible breakthrough technology in the future of payments. Crypto investors turned to stablecoins in an attempt to safeguard their capital while the global crypto market experienced a meltdown.