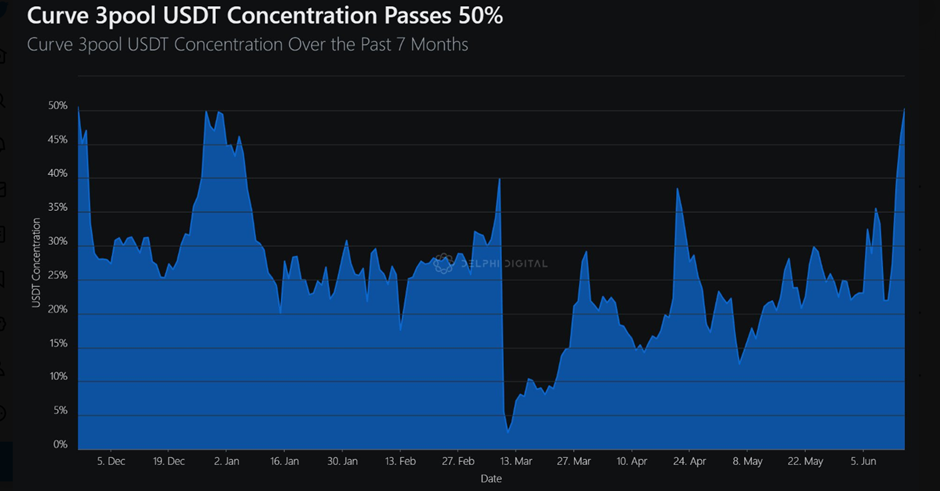

In a surprising turn of events, whales have been dumping the stablecoin USDT in exchange for USDC and DAI, resulting from the imbalance of the exchange liquidity pool Curve 3Pool. According to the crypto analyst Miles Deutscher, the current Curve 3Pool USDT concentration is the highest since the collapse of the crypto exchange FTX.

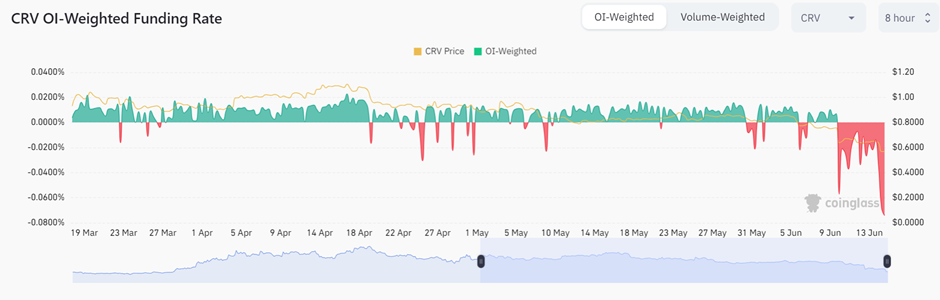

As per a tweet shared by the Chinese reporter Collin Wu, the perpetual contract for CRV token’s funding rate has been standing at a rate of -0.0733, reaching a new yearly low.

The perpetual contract for CRV had a funding rate of -0.0733% over 8 hours of trading volume, reaching a new low for the year, with shorts subsidizing longs. CRV has fallen by more than 10% in the past 24 hours. https://t.co/BRlf6Bt6Jj

— Wu Blockchain (@WuBlockchain) June 15, 2023

The reporter added that the grave decline in the funding rate of CRV could be a result of the “bet on the liquidation of the position held by Curve founder michwill (0x7a…5428) by short sellers”. According to his findings, the address holds about 50% of the total circulating supply of CRV tokens.

In related news, it has been identified that a large number of crypto traders have been busy accumulating USDC and DAI in exchange for USDT. Deutscher took to Twitter to invite his followers’ attention to the growing concerns over Tether. He added that “the sudden spike in inflows is very abnormal”.

Recently, as per the details shared by the crypto analytics platform Lookonchain, the CRV founder deposited CRV to the decentralized protocol Aave, borrowing USDC and USDT. 291 million CRV tokens, equivalent to 34% of the total circulating supply have been moved by him; he borrowed $65 million USDT and USDC.

Currently, the CRV token is trading at a price of $0.5741, with an 11.64% fall in the past 24 hours. At the same time, USDT is trading $0.9961, exhibiting a decline of 0.34% in one day.