- Injective’s price soared from $1.27 to $39.70, marking a 2,700% increase, largely driven by AI integration.

- Artificial Intelligence dominated crypto narratives in 2023, leading to Injective’s significant market performance.

- Despite a 920% rally, Solana fell behind Injective and faced institutional outflows, losing some market stature.

Injective has marked an astonishing year in 2023, recording a staggering 2,700% increase in its price. This remarkable surge took the crypto from $1.27 to an impressive $39.70, creating substantial gains for its investors and solidifying its position in the crypto market.

In a year where the crypto market saw various ups and downs, Injective’s performance stood out, especially when compared to Solana. Despite Solana’s substantial 920% rally, it was outshined by Injective’s explosive growth. This shift signifies a changing dynamic in the crypto market, where new narratives and technologies can rapidly alter the landscape.

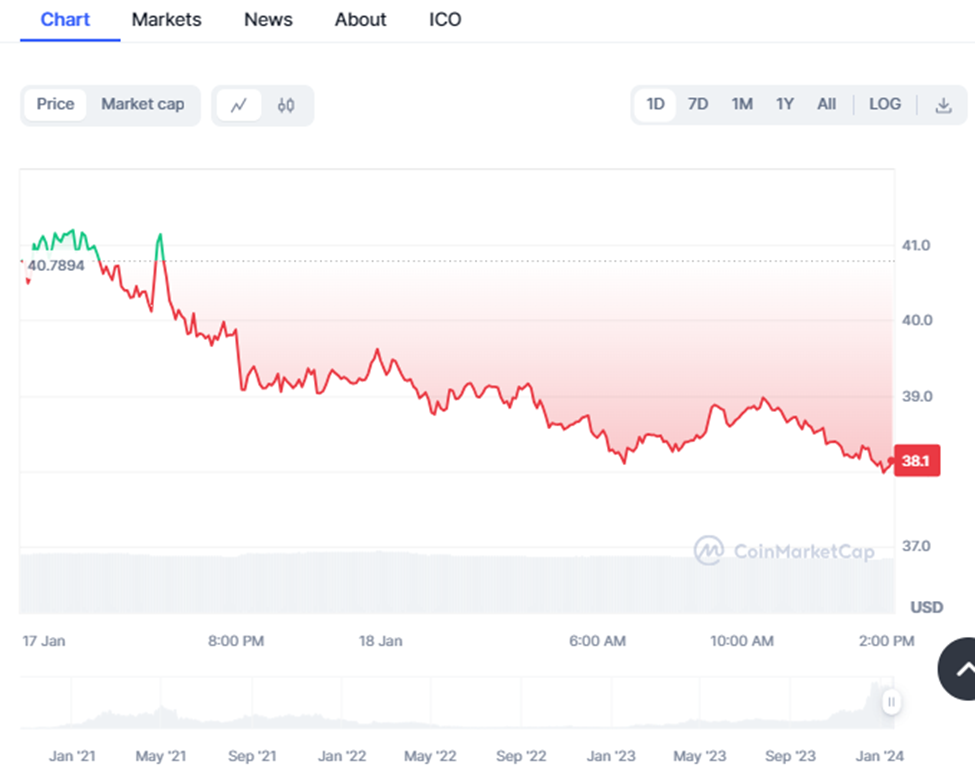

As of press time, Injective is facing a downtrend as the market conditions present a bearish outlook. As leading currencies such as Bitcoin and Ethereum trade on a bearish note, INJ has not been left behind, recording a decrease of over 6 percent in the past 24 hours, with the current price at $38.1. If the trend holds, INJ will likely test the previous support level at $37, dropping the price below the immediate resistance at $38.

2023 was a year where Artificial Intelligence (AI) took center stage in the crypto narrative. Accounting for a significant 11% of the market share, AI’s integration into the crypto world was pivotal in driving the market’s interest and investment. Injective’s alignment with this trend, highlighted in CoinGecko’s 2023 Annual Crypto Industry Report, contributed significantly to its popularity and price.

While Injective soared, Solana faced challenges, particularly in maintaining its stature among institutional investors. The CoinShares weekly institutional investment report revealed Solana experiencing outflows totaling $5 million monthly. This trend, though not drastically bearish, indicates a shift in institutional confidence, potentially impacting Solana’s future market position.

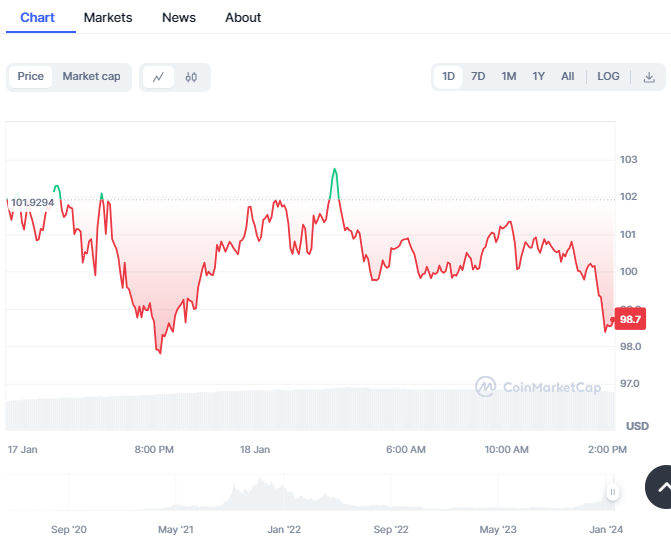

SOL is trading at $98.78 as of this writing, down by 2.79 percent since yesterday’s close of $101.38. SOL dropped below the key level of $100 after failing to break past $103, the current resistance, thus facing a pullback to hit a daily low at the $98 mark. However, there has been a significant surge in the daily trading volume, suggesting a trend reversal that could be imminent in the SOL market.

In conclusion, Injective’s extraordinary performance in 2023, driven largely by the burgeoning AI narrative in crypto, has set a new standard in the industry. As the industry continues to evolve at a breakneck pace, the interplay between technological innovation and market forces will undoubtedly shape the future landscape. Meanwhile, Solana’s evolving position serves as a reminder of the relentless competition and continuous innovation that define the cryptocurrency world.