- The recent surge in Bitcoin is notably driven by institutional investors, as seen in increased trade sizes.

- Bitcoin’s bullish momentum is sustained, consistently above crucial moving averages, indicating enduring market confidence.

- Institutional strategies shape the market dynamics, marked by calculated moves, emphasizing a transformative influence on Bitcoin.

The recent surge in Bitcoin (BTC) is with institutional investors emerging as the driving force. Delving into the data from U.S. exchanges, a noteworthy uptick in the average trade size since September captures attention, signaling the possible involvement of substantial, potentially institutional, trades propelling the market skyward.

A closer look at the BTC-USD Average Trade Size chart paints a compelling picture. The average transaction value has increased, weaving a narrative where institutions likely wield significant influence in propelling Bitcoin’s ascent. Larger trade sizes, a key metric, imply the participation of players with deeper pockets—entities like hedge funds, family offices, and corporate treasuries capable of executing more substantial investments into the market.

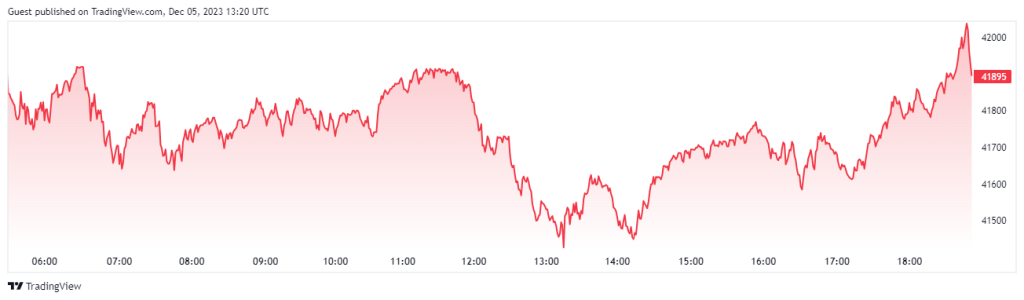

Turning our focus to the Bitcoin price chart, it becomes evident that the cryptocurrency’s bullish momentum is not a mere coincidence. Following a period of consolidation, Bitcoin has undergone a swift and decisive upturn. Impressively, the price has consistently held above both the 50-day and 200-day moving averages, signaling a robust and sustained bullish sentiment.

A closer examination of the moving averages reveals a distinct pattern—fanning out—an interpretation often associated with strengthening momentum. This further solidifies the notion that the recent surge is not a fleeting trend but a result of growing and enduring market confidence.

The recent green candles on the price chart provide additional insights, their substantial bodies reflecting aggressive buying pressure. Notably, the absence of long wicks suggests that any pullbacks are swiftly absorbed, underscoring the existence of a robust underlying bid in the market. Such a scenario aligns with the characteristics of institutional investment—strategic, high-volume purchases rather than rapid-fire trades.

Assessing the immediate future, Bitcoin seems to encounter resistance at recent highs, with potential retracements poised to examine the resilience of current support levels. The dynamics at play indicate a market shaped by institutional strategies, where the ebb and flow are orchestrated by calculated moves rather than impulsive actions.