- Modest long liquidation & lack of negative funding ratios suggest the futures market may not have seen full capitulation yet.

- Shift in key support/resistance levels & head-and-shoulders pattern formation accentuate market uncertainty.

- Bitcoin’s trading volume remains robust despite marginal price increase, indicating sustained market activity.

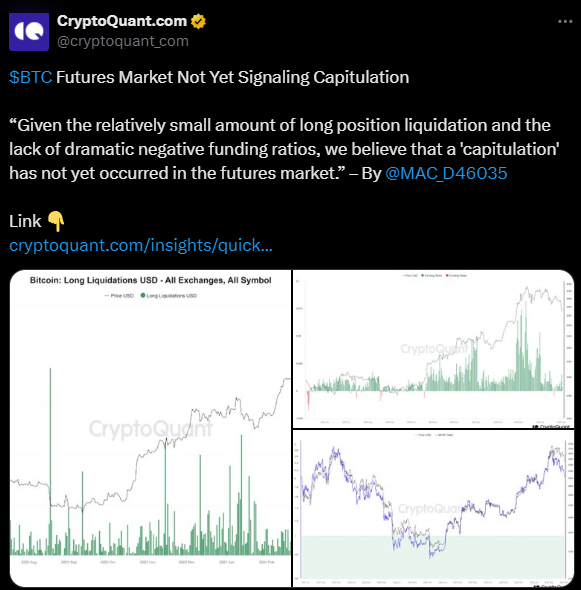

Bitcoin’s recent price movements have left many investors on edge, with the futures market offering some insights but not yet signaling a definitive capitulation. Despite the breach of the crucial $59,000 support level, the liquidation of long positions amounted to approximately $120 million, a notable figure but not as substantial as previous occurrences.

As highlighted by CryptoQuant, a top analytic firm, this relatively modest liquidation, coupled with the absence of pronounced negative funding ratios, suggests that a full-blown capitulation in the futures market may still be on the horizon.

Moreover, the Funding Ratio indicator has intermittently displayed negative ratios on an hourly basis, but these values have not been sufficiently drastic to indicate a widespread rush to short positions. Historically, significant market bottoms have been characterized by extensive liquidation in the futures market and a surge in shorting activity. However, the current landscape falls short of these criteria, indicating that the market may not have experienced a true capitulation event yet, potentially paving the way for further downside.

A closer look at the shorter-term Bitcoin chart reveals a shift in key support and resistance levels, further accentuating the uncertainty in the market. As noted by Peter Schiff, a Chief Economist & Global Strategist, previously established support at $60,000 has now transformed into a formidable resistance barrier.Additionally, the chart pattern suggests the formation of a short-term head-and-shoulders top.

The head is positioned just shy of $60,000, while the shoulders hover around $58,500, with the neckline positioned slightly below $57,000. Should this pattern materialize, the downside target could extend to $54,000.

At press time, Bitcoin is trading at $57,628.63, exhibiting a marginal increase of 0.39% over the past 24 hours. However, the trading volume remains robust at $44,554,108,252, indicating ongoing market activity and interest.