U. S Treasury yields are rising reflecting Fed’s to increase rates more sharply to tame inflation

Inflation and a debt crisis could be the cornerstone for the next financial crisis. In the U.S., the consumer inflation is still at higher levels around 6.4%, and it seemed a perfect background for the Federal Reserve to ramp up its momentum of a rate hike. To pull back inflation back to its target the rate hike could be above 6%.

If that happens, this could spark a severe recession combined with the stock market crash, and default in debt. As per econometrics, if the market is heading toward a period of recession, then the riskier asset would dig further deep down.

The most prominent sign of an upcoming recession is the inversion of the yield curve. That means the yield is higher for the short-term treasury than the long-term. Two-year bond yields hit a 16-year high and now are 4.929%, which is nearly a percentage point higher than the yield on the 10-year U.S. Treasury yield.

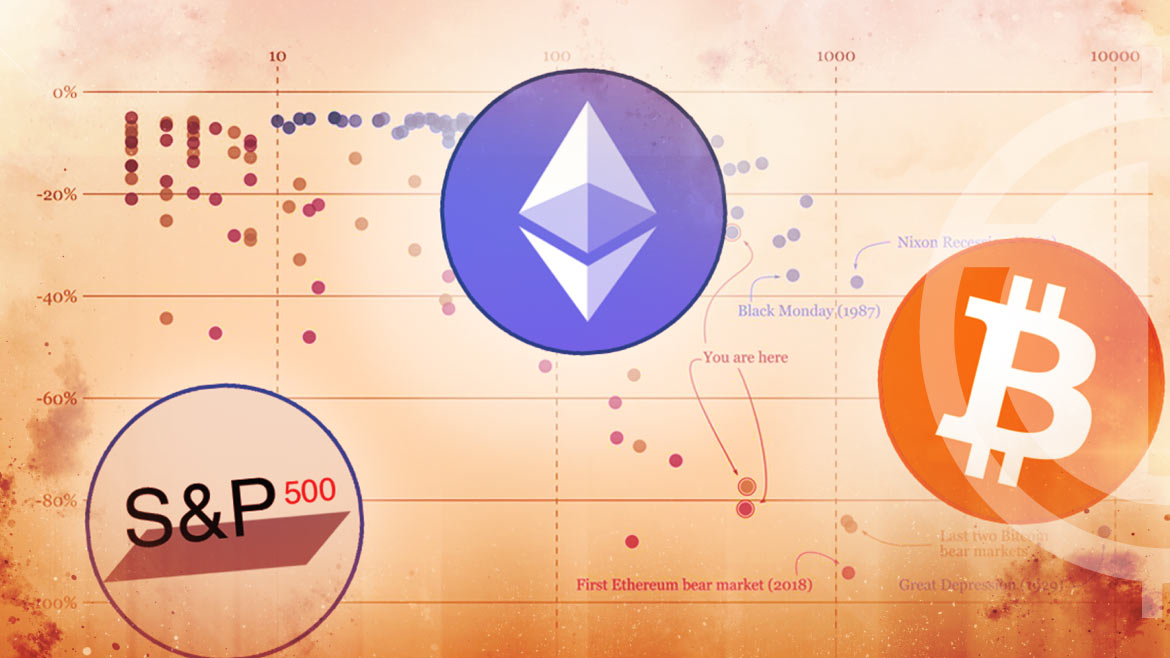

Now, in such a scenario, the riskier assets could see really bad weather in these conditions. The S&P 500, which fell 20% last year incurred the probability to slide further by 30% as per market analysts as investors shy away from the riskier portfolio in extreme macro conditions.

The escalating risk of recession also creates volatility for crypto assets as well. Bitcoin has a strong correlation with the U.S. stock market. BTC price consolidates near $22K, and the risk of a downturn alongside stocks is increasing.

Ethereum is also on the verge of a fall if breaks below $1500.