- Metaplanet acquired 20.2 BTC, increasing the total BTC collection to 161.27 BTC.

- The platform’s $6 million strategy follows the prior BTC purchases worth ¥200M.

- The firm’s stock rose 10% after the third Bitcoin purchase

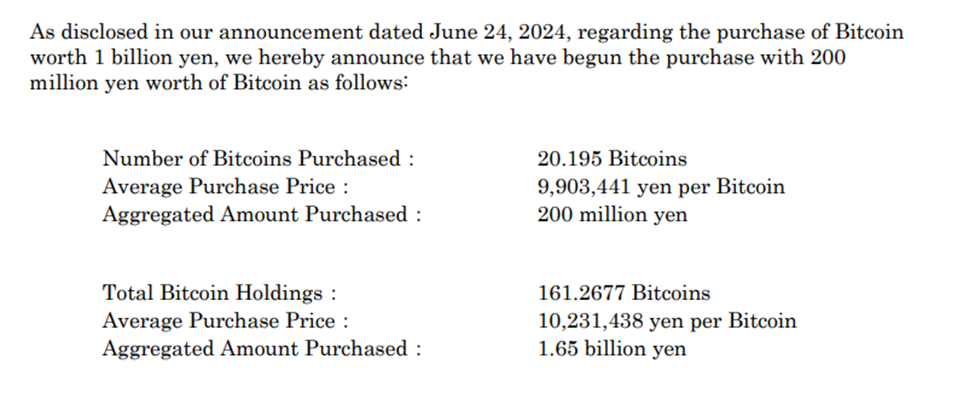

Metaplanet, a Japanese investment firm, said it purchased more than 20.2 bitcoins (BTC) as part of a $6 million strategy to increase BTC holdings in its treasury. The Tokyo-based corporation said on X that they had started purchasing 200 million yen worth of Bitcoin, as stated in their June 24, 2024 statement. The breakdown is as follows:

Metaplanet’s Fourth Purchase in Four Months

Metaplanet has been on a Bitcoin acquisition spree over the last two months, following in the footsteps of MicroStrategy. Metaplanet’s fourth Bitcoin purchase in four months brings its total holdings to 161.27 BTC, valued at around ¥1.6 billion (more than $10 million).

A week ago, the business said that it wanted to expand its bitcoin holdings by purchasing an extra $6 million in BTC. It already possessed 141 BTC, which was worth approximately $9.4 million of the world’s largest cryptocurrency by market capitalization. Metaplanet had previously purchased on April 23, May 10, and June 10. Metaplanet’s stock jumped 10% after the third buy.

Metaplanet’s Vision of Investing in BTC

Tokyo-listed Metaplanet, a firm that concentrates on hotel development and real estate, has turned its attention to Bitcoin investment, utilizing it as a strategic reserve asset to buffer against Japan’s debt burden and the resultant currency volatility. The move is significant because it occurs at a time when Japan’s economic problem is thought to be playing out in the currency market. Bitcoin has long been touted by crypto supporters as a hedge against fiscal and monetary irresponsibility.

Sony Enters Crypto Market with Strategic Amber Japan AcquisitionFollowing in MicroStrategy’s Footsteps as it Leads with Massive Holdings

The bitcoin-accumulation strategy is similar to that of Tysons Corner, Virginia-based software developer MicroStrategy, which has been buying BTC for nearly four years. As of July 1, global public companies owned a total of 321,223 BTC, with MicroStrategy leading the way with 226,331 BTC, accounting for more than 1% of the total number of bitcoins ever issued.