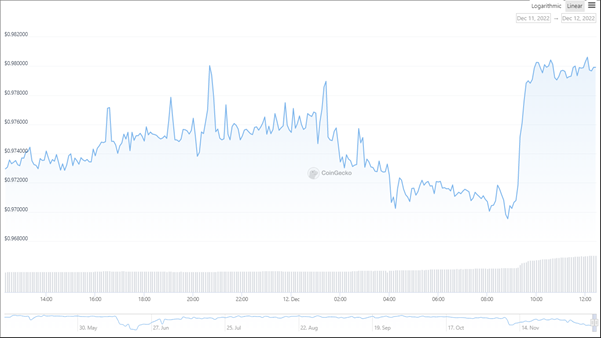

The price of Justin Sun and TRON’s algorithmic stablecoin USDD, which is now at $0.98, has recently seen a decline. According to the analytics site Coingecko, at one point in time it even plummeted lower than $0.97, reaching its lowest value since June 22. The fall exceeded the 3% price fluctuation threshold set by the DAO, which determined whether or not price changes were deemed de-pegs.

According to the decentralized exchange Curve, the protracted de-pegging of USDD is accompanied by a continuous growth in the stablecoin’s dominance rate inside the USDD/3CRV liquidity pool.

A few hours ago, more than $4 million USDD in liquid assets were taken from Curve Finance. This accounts for more than 12.83% of the overall pool share. The liquidity pool of Tron’s USDD on Curve has become very skewed, with USDD accounting for 86.1% of the pool’s total value.

In the wake of the collapse of the cryptocurrency exchange FTX, the Tron native algorithmic stablecoin was unable to successfully repeg against the US dollar. As a direct consequence of this, the price of Tron (TRX) dropped by more than 2% in one hour and by 5% in the preceding 24 hours.

On Twitter, Justin Sun revealed that he is increasing the amount of cash that is being used to protect USDD. He also emphasized that the algorithmic stablecoin has a collateral ratio of 200%. This was done in an effort to ease the jitters of the market.

Tron’s USDD has been doing very well, especially considering it was released in the wake of the Terra UST meltdown in the spring of 2022. Tron’s over-collateralized, decentralized stablecoin has been instrumental in the smart contract blockchain doubling its market share. However, the latest FTX fiasco has been a major setback.