- Major CEX listings for Runes could significantly boost liquidity and investor interest, driving renewed hype.

- Bitcoin soft forks like OP_CAT could enhance BTCFi scalability and functionality, attracting more investment.

- Launching stablecoins on Bitcoin using Runes may increase demand as AMMs and dApps improve user experience.

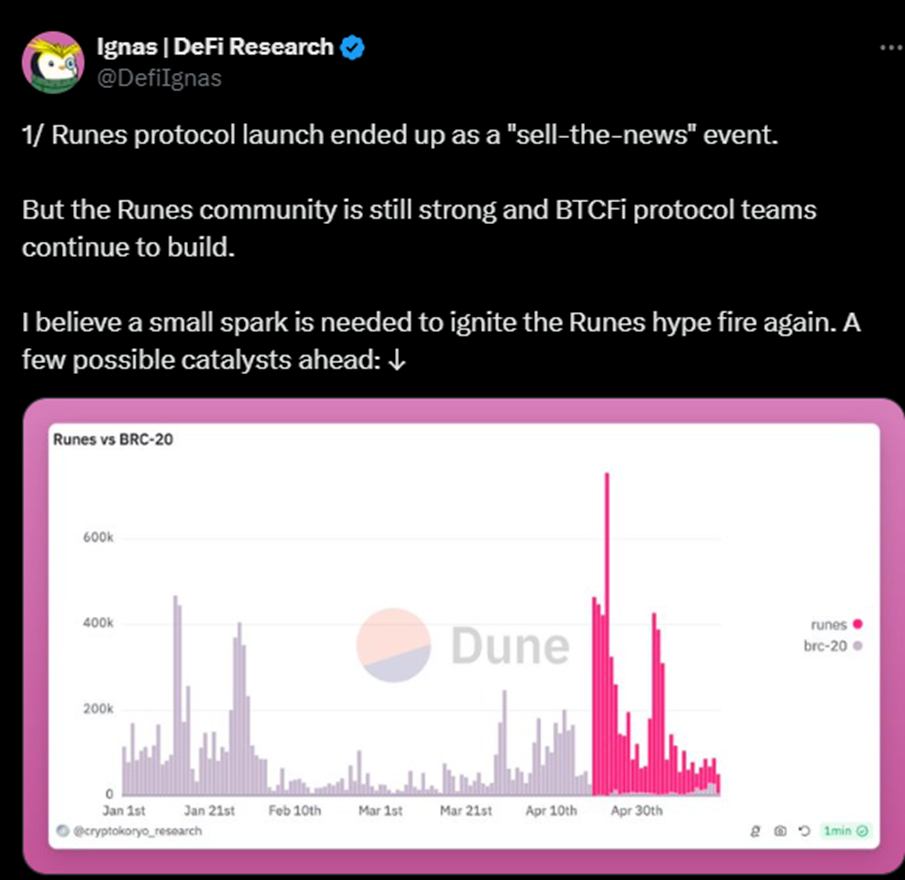

The recent launch of the Runes protocol turned out to be a classic “sell-the-news” event, dampening initial enthusiasm as highlighted by Ignas, Co-founder of PinkBrains. However, the Runes community remains resilient, and development teams within the BTCFi protocol continue to build.

As further noted by Ignas, the listing of Runes tokens on major centralized exchanges (CEXes) presents a significant opportunity. Both Kraken and Binance have recently published research reports on Runes, signaling growing institutional interest. Kraken has even hinted at a potential Runes listing.

Currently, trading Runes is akin to trading BRC20 tokens, with some interface improvements courtesy of Magic Eden. A major exchange listing could provide the liquidity and visibility needed to attract new investors and traders.

Moreover, Bitcoin soft forks or the speculation thereof, such as the proposed OP_CAT, could bring about substantial enhancements for Bitcoin Layer 2 solutions, smart contracts, and the broader BTCFi ecosystem.

These technical advancements are crucial for improving scalability and functionality, making Bitcoin more versatile and efficient. Such developments could serve as a strong catalyst, sparking renewed interest and investment in Runes and other BTCFi projects.

Another potential driver of BTCFi growth is the launch of stablecoins like USDC or USDT on Bitcoin, utilizing the Runes protocol. Circle and Tether could pre-mine substantial quantities of Rune tokens, issuing and redeeming them as needed.

Although current demand for stablecoins is modest, it is expected to rise as Bitcoin Automated Market Makers (AMMs) and lending decentralized applications (dApps) enhance their user experience. Improved UX in these areas could lead to greater adoption and integration of stablecoins within the BTCFi space.

In addition to these anticipated catalysts, unexpected events or innovations often play a pivotal role in crypto market dynamics. Hence, the next wave of FOMO (fear of missing out) might emerge from an unforeseen development, further fueling the Runes hype.

Historically, narratives based on technological innovation tend to experience multiple waves of interest. BTCFi, being one of the most significant innovations of this cycle, is likely to follow this pattern.