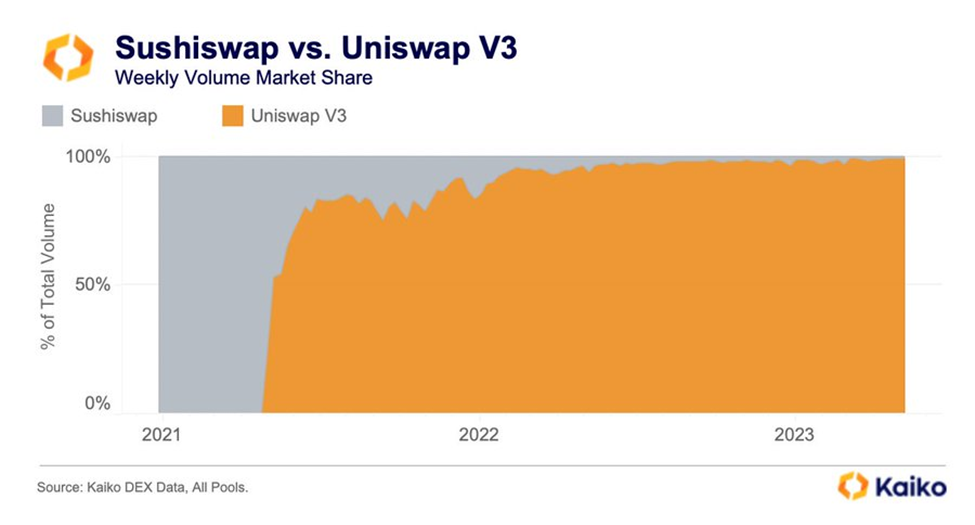

As a part of its recent DEX data research, digital asset data provider Kaiko Data shared a graphical presentation of the weekly volume market share between the decentralized crypto exchanges SushiSwap (SUSHI) and Uniswap V3.

In a tweet shared by the data provider, a significant question on the “future of Sushiswap” is raised:

What is the future of Sushiswap?

— Kaiko (@KaikoData) May 17, 2023

Today, the DEX has less than 1% market share relative to Uniswap V3, its biggest competitor. pic.twitter.com/RwnKl38DhI

The data aggregator shared concerns regarding the future of Sushiswap when it has less than 1% market share relative to its rival Uniswap V3. The graph shared by Kaiko clearly showed how drastically Uniswap V3 has eclipsed SushiSwap in 2023 in terms of trading volume.

Starting in 2021, the weekly volume market share of Uniswap has been rising exponentially (crossing the 50% mark by 2022 and nearing 100% in 2023) compared to Sushiswap’s humble beginnings.

SushiSwap, a Uniswap hard fork, is an automated market maker (AMM) with SUSHI as its native DeFi token. Uniswap V3 is a protocol on Ethereum that swaps ERC20 tokens. But the aerial view of the DEX world throws light on other incumbent challengers to SushiSwap and Uniswap V3.

Tradecurve.io and InQubeta have already begun drawing investor attention and money away from SushiSwap and Uniswap. Tradecurve facilitates users to access different markets whilst trading from a single account. While Tradecurve.io is a new hybrid non-custodial trading exchange, InQubeta helps AI (artificial intelligence) start-ups raise capital.

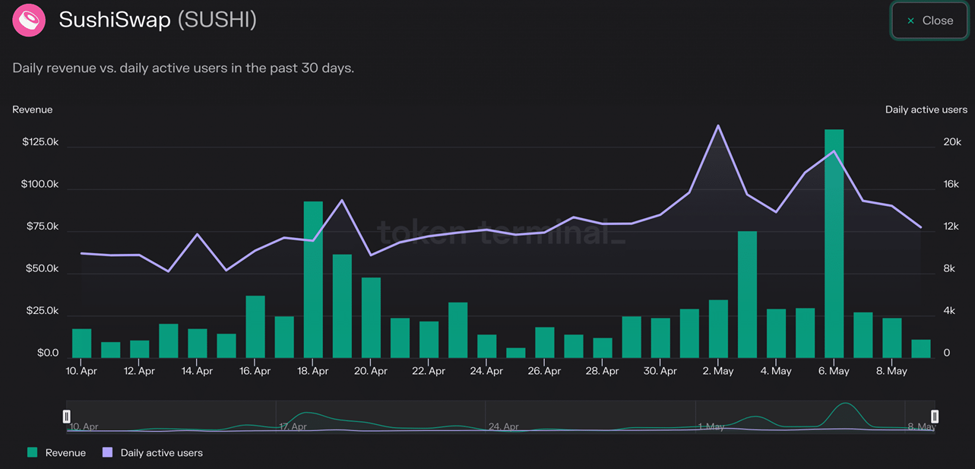

In related news, SushiSwap has unveiled V3 liquidity pools for DigiToads (TOADS), having reportedly raised over $3.2 million in presale. The volumes on Centralized Exchanges (CEX) reportedly decreased following Binance and OKX’s fallen trade volumes. While spot trading volumes on Binance and OKX fell by 46.9% and 36% compared to last month, their futures trading volumes fell 24.1% and 21.7%, respectively. Meanwhile, SushiSwap reportedly experienced a rise in its daily activity with a 25% rise, as its revenue increased by 10.1%.

At press time, SUSHI is trading at $0.8913, with a market capitalization (MCAP) of $205,082,327 and a 24-hour trading volume of $15,206,502. Uniswap is trading at $5.15, with an MCAP of $2,970,111,321 and a 24-hour trading volume of $35,303,533.