- Bitcoin’s value drops, trading below the crucial $29K mark.

- Top-10 cryptocurrencies, including ETH, BNB, and DOGE, witness declines.

- The market capitalization of cryptocurrencies contracts to $1.13T, reflecting a 1.82% decrease.

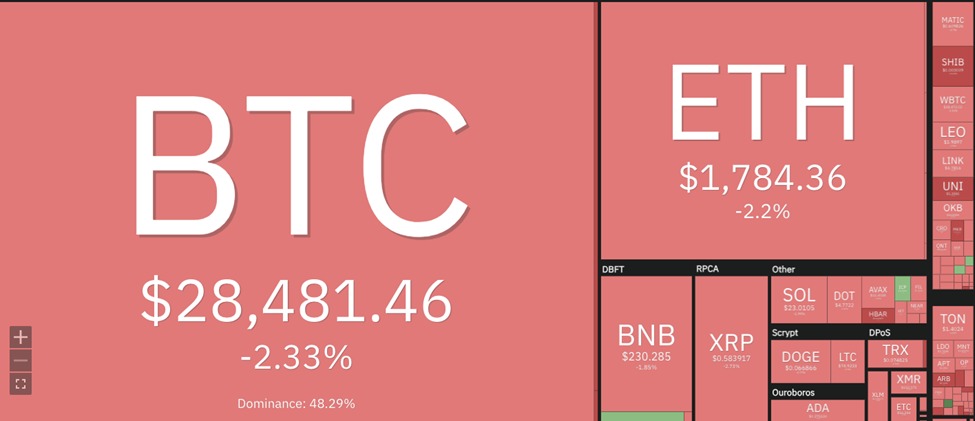

In recent market developments, Bitcoin, the pioneering cryptocurrency, has experienced a downward trend, currently trading beneath the significant $29,000 threshold. As of the latest reports, Bitcoin’s value is $28,773.68, marking a 1.24% decrease within the past day. This decline comes after Bitcoin’s brief stint above the $29K mark, indicating that the digital currency couldn’t sustain its momentum amidst the prevailing bearish pressure.

CryptoRank Platform, a crypto market data aggregation and analytics platform, shared a post on the bearish performance of the top 10 cryptocurrencies:

📈Market Overview #Bitcoin price trades below $29K

— CryptoRank Platform (@CryptoRank_io) August 17, 2023

The Top-10 cryptocurrencies are traded in red zone: $DOGE -4.03%, $BTC -1.95%, $XRP -1.87%.

Market capitalization: $1.25T (-1.56%)

The #BTC dominance: 44.55% (-0.29%)

Fear & Greed Index: 50 (Neutral) pic.twitter.com/7kWkk83O4B

Ethereum (ETH), another heavyweight in the cryptocurrency arena, hasn’t been spared from the market’s bearish tendencies. Currently priced at $1,790.55, it’s evident that Ethereum is grappling with a decline, having fallen by 1.56% since yesterday. The price now lingers below the $1,800 mark, and market analysts anticipate a potential further dip in its value in the upcoming days.

Other prominent digital currencies, including Binance Coin (BNB), Ripple’s XRP, and Dogecoin (DOGE), also navigate a sea of red. BNB’s current trading price is $230.73, reflecting a 1.56% drop from its previous day’s value. Meanwhile, XRP, with a 2.59% decrease, is now trading at $0.5851. Dogecoin, however, has taken one of the most significant hits among the top 10 cryptocurrencies, plummeting by 4.03%.

The prevailing bearish sentiment in the cryptocurrency market is evident, as a majority of digital currencies are struggling to post notable increases in their values. This stagnation and a reduced appetite for buying have urged veteran and new investors to proceed cautiously. The market’s overall value is a capitalization of $1.13T, marking a decline of 1.82%.

The future trajectory of the crypto market remains uncertain. The current bearish trend could continue, or a bullish rally might reverse the downturn, driving the market to new heights. Investors and traders are advised to stay informed, monitor market indicators such as the Fear & Greed Index (currently at a neutral 50), and make informed decisions.

In conclusion, the cryptocurrency market is currently in a state of flux, with major players like Bitcoin, Ethereum, and others facing declines. As the digital currency landscape continues to evolve, stakeholders are keenly watching for signs of recovery or further dips. The coming days would be crucial in shaping the direction of the crypto market.