- DYDX prepares for major token distribution, releasing funds to investors, team members, and future employees totaling over $90 million.

- The market anticipates significant movement as DYDX prepares for three major token unlock events this month, affecting over 11% of circulating tokens.

- With over 60% of DYDX tokens still locked, future unlock events could introduce new dynamics to the market in the latter half of the year.

DYDX is at the cusp of a significant phase in its market journey, with a massive token unlock event scheduled for this month. This event will see over $90 million in tokens released into the market, constituting 11.31% of the circulating supply. This release, divided among various stakeholders, marks a pivotal moment for DYDX.

The current unlock event distributes the tokens in three major segments. Investors are set to receive tokens worth $49.36 million, which forms the largest share. Additionally, team members, advisors, and consultants are earmarked for $27.18 million. Moreover, future employees have been allocated tokens amounting to $12.46 million. This strategic distribution underscores DYDX’s commitment to its long-term stakeholders and workforce.

Significantly, this unlock event is not a one-off occurrence. DYDX plans to replicate this size of token release four more times. Consequently, market participants and observers should pay close attention to these events, as they could substantially influence the market dynamics of DYDX.

However, it’s crucial to note that DYDX still has most of its tokens under lock and key. More than 60% of DYDX tokens remain locked, maintaining a level of scarcity in the market. This factor could be critical in the token’s value and market perception.

Looking ahead to the year’s second half, DYDX plans to alter its unlock strategy. The portion of tokens scheduled for release will see a significant decrease. This planned reduction indicates a more gradual approach to token distribution, potentially stabilizing market reactions.

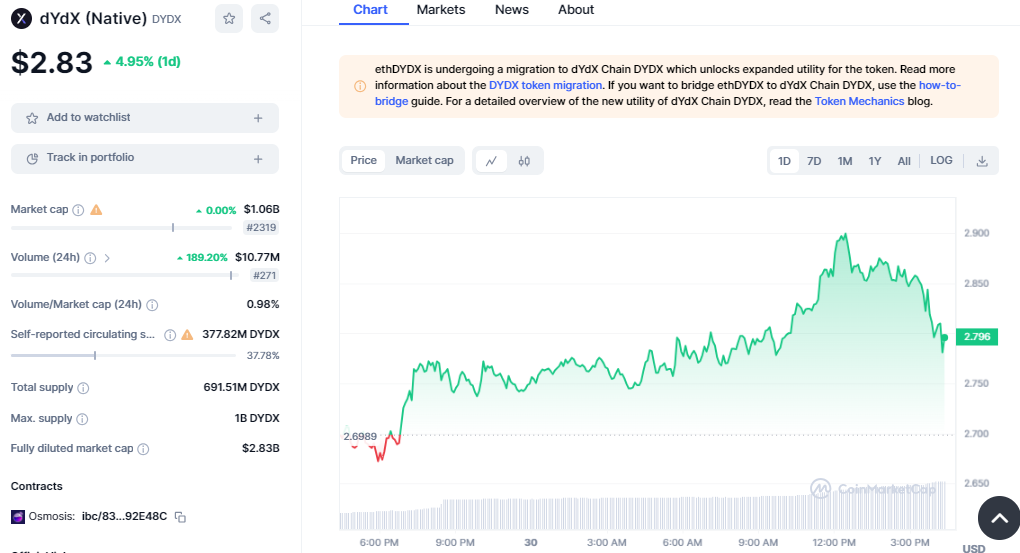

DYDX is currently exchanging hands at $2.82, up by over 4% in the past 24 hours. DYDX rose from a daily low of $2.67 to $2.90 before facing a pullback to $2.83, where it currently trades. Amid the bearish momentum surrounding DYDX, the coin has gained over 10 percent over the past week as the price recovers from the dip. Today, the daily trading volume has been relatively high as the buying pressure increases, pushing the price higher. If the current trend holds, DYDX could retrace the $3.00 level, pushing for a break above the key resistance at $3.20.

In conclusion, DYDX’s upcoming unlock events are key milestones in the crypto asset’s journey. The significant amount of released tokens and the strategic allocation to different stakeholders could have far-reaching implications for DYDX’s market performance. As more than half of the tokens remain locked, the market’s reaction to these unlock events could provide valuable insights into the future trajectory of DYDX.