- MATIC defies market norms with a massive influx of 55 million tokens, surprising analysts.

- Two colossal MATIC transactions to Coinbase add intrigue, signaling potential market-shifting dynamics.

- Bullish indicators like MACD and A/D signal MATIC’s poised surge, setting the stage for a $1 breakthrough.

In a surprising turn of events, over 55 million Polygon (MATIC) tokens were swiftly sent to Coinbase from unknown addresses, triggering concerns of a potential sell-off. Historically, large token transfers to exchanges often lead to a negative impact on prices. However, MATIC has defied the odds, maintaining a robust stance in the market.

In a recent tweet by crypto analytic firm Whale_alert, a substantial transaction unfolded—17,655,976 #MATIC (14,591,597 USD) transferred from an unknown wallet to Coinbase:

As of writing, MATIC is trading at $0.876, reflecting a 3.09% increase in the last 24 hours and an impressive 63.25% surge in the past 30 days. Despite the influx of tokens into Coinbase, MATIC has displayed resilience against downward pressure, leaving market participants speculating on its next move.

Notably, the renowned Whale Alert signalled another whopping transaction involving 19,896,435 MATIC ($16,443,201 USD) moved to Coinbase:

The rise in MATIC’s value aligns with a significant increase in buying power, as evidenced by the one-hour MATIC/USD chart. On November 12, the token experienced a notable uptick from $0.78, indicating a prevailing bullish sentiment. The Accumulation/Distribution (A/D) indicator further supported this upward trend, reaching 1.34 billion that signals a strong breakout for MATIC.

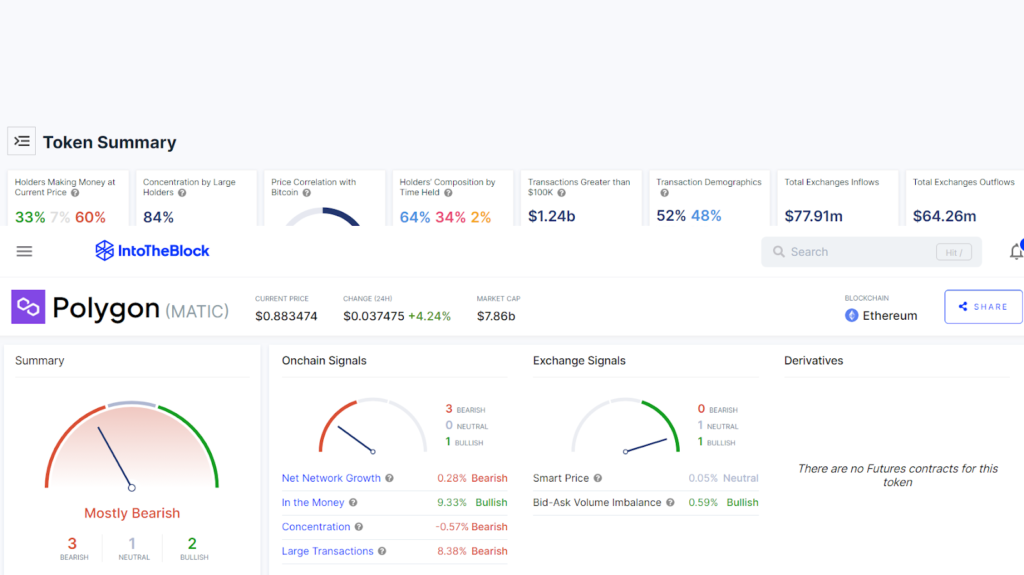

Technical indicators such as the Moving Average Convergence Divergence (MACD) have also entered the positive region, affirming the growing upward momentum. This positive signal, coupled with the A/D indicator, suggests that MATIC may be gearing up for a potential surge. The on-chain analysis by Into The Block unveils a complex narrative. With a market cap of $7.86 billion and 84% concentration among large holders, MATIC’s price correlation with Bitcoin at $0.88 suggests a strong link to the king cryptocurrency’s movements.

Notably, 33% of MATIC holders are currently in profit at the current price, while 60% are out, highlighting the resilient nature of MATIC against potential downward pressure. The concentration by large holders and a bullish price correlation with Bitcoin could potentially fuel MATIC’s upward trajectory.

Transaction demographics reveal a dominance of large transactions, with transactions exceeding $100K totaling $1.24 billion in the last 7 days. Despite a bearish signal from net network growth (-0.28%), the in-the-money metric is bullish at 9.33%, indicating a significant portion of investors being in profit.

While concentration has a slight bearish tilt at -0.57%, large transactions, another bearish signal at 8.38%, pose a potential concern. The smart price signal remains neutral at 0.00%, suggesting cautious optimism in the market.

On the exchange front, total inflows over the last 7 days amount to $77.91 million, slightly overshadowing the outflows of $64.26 million. This influx could be attributed to the recent whale activity observed on the Polygon network, contributing to MATIC’s resilience in the face of potential sell-offs.

Investors are now closely watching MATIC’s performance, with technical indicators like Bollinger Bands (BB), Relative Strength Index (RSI), and Moving Averages (MA) pointing towards a potential upward trajectory. The cryptocurrency community awaits further developments as MATIC continues to defy market expectations, leaving the $1 milestone within tantalizing reach.