- NYCB’s drastic stock decline has sparked debates on the stability of regional banks and the implications for a more comprehensive financial system.

- The bank’s significant exposure to commercial real estate loans is a primary factor behind its current financial distress.

- Despite the tumult, there’s no definitive sign that NYCB is facing imminent failure, with deposit flows being a critical indicator to watch.

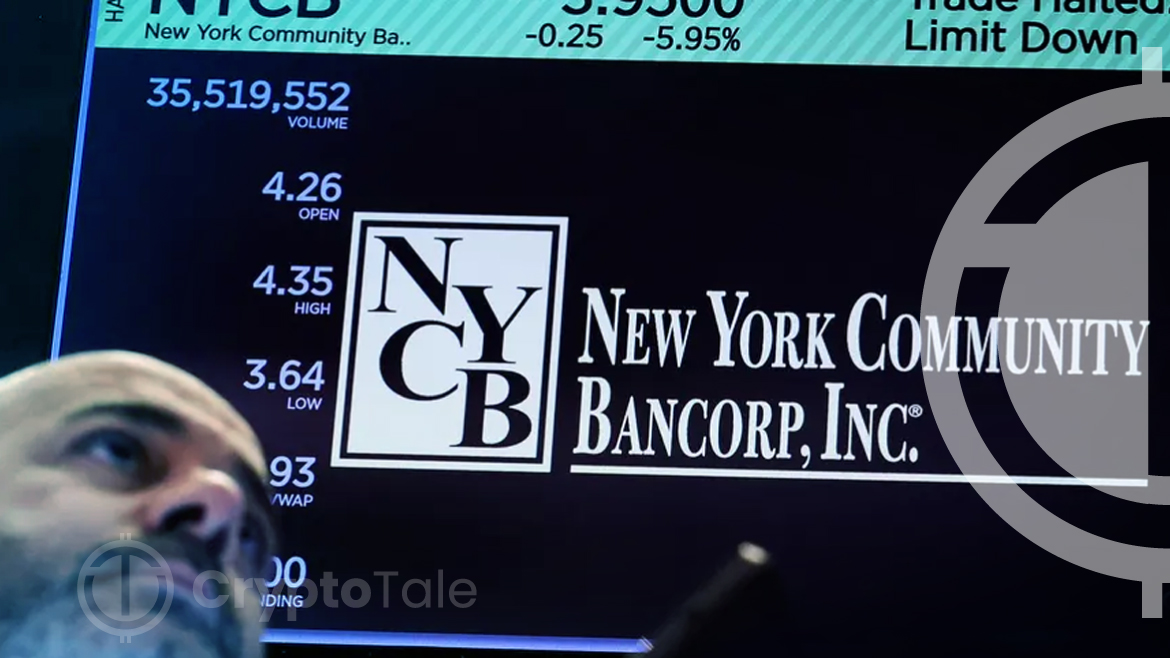

In recent times, the US banking sector has been under scrutiny following the collapse of several prominent banks, casting a shadow over the financial stability of regional banks. Among them, New York Community Bancorp (NYCB) emerged as a focal point of concern after its share value plummeted by 60% within a week.

The situation worsened when Moody’s Investors Service relegated the bank’s credit rating to non-investment grade, sending its shares down by an additional 8% in premarket trading.

CryptoBusy, a crypto trader and market analyst, shared an X post providing the perspective that the recent troubles NYCB and the broader regional US bank crisis might inadvertently act as a catalyst for increased interest and investment in Bitcoin.

This downturn was sparked by the bank’s revelation last week of a surprising quarterly loss of $252 million, starkly contrasting the $172 million profit recorded in the final quarter of 2022. The losses were primarily attributed to deteriorating commercial real estate loans, reflecting the changing dynamics of the workplace and the diminishing demand for office spaces.

Adding to the bank’s woes was the absorption of $40 billion in assets from the failed Signature Bank, pushing NYCB’s total assets beyond the $100 billion mark. This significant milestone triggers stricter regulatory requirements, including higher capital reserves, limiting the bank’s lending capabilities.

Financial experts argued that the initial market reaction to NYCB’s financial disclosures, though severe, did not necessarily signal an imminent failure. However, the continued downward trajectory of the stock price has amplified concerns over the bank’s sustainability. The fear among investors and uninsured depositors, those holding over $250,000 in their accounts, is palpable as they worry about the bank’s ability to safeguard their funds.

Despite these fears, no concrete evidence suggests that NYCB is on the brink of failure. Analysts pointed out that deposit flows are the most reliable indicator of a bank’s health. Until the last quarter, NYCB only reported a modest 2% deposit dip, with an even smaller decline when excluding the custodial deposits associated with the Signature Bank acquisition.

Following the alarming earnings report, Bank of America analysts relayed that NYCB management has not observed any unusual deposit activity. However, the bank has yet to release an official statement.

In response to the brewing crisis, Treasury Secretary Janet Yellen has assured the public of the government’s active engagement with banking supervisors to monitor the situation closely. Yellen highlighted the potential risks posed by commercial real estate to financial stability but refrained from commenting on the specifics of NYCB’s condition.

Bitcoin has soared past the $61,000 resistance, trading at $61,959, marking a 0.63% daily increase. Ranked 1st on CoinMarketCap, its live market cap is $1.215 trillion, indicating strong bullish momentum and investor confidence in the leading cryptocurrency’s market performance.

As the financial community watches closely, the unfolding situation at New York Community Bancorp serves as a reminder of the fragility of the banking sector in times of economic uncertainty. With the potential for the regional US bank crisis to extend its reach, investors and consumers increasingly consider alternative assets, such as Bitcoin, as viable options for safeguarding their wealth.