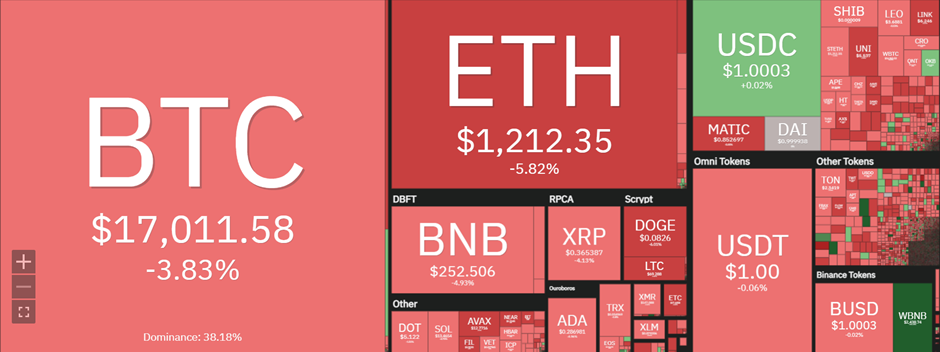

Overall market crypto analysis shows the cryptocurrency market is starting to come back down to earth after the short-lived bull run. Bitcoin (BTC) and Ethereum (ETH) are both lower since the beginning of today’s trading session, with most altcoins following suit. The total market capitalization is down to $827.7 billion, a decrease of around 8% since yesterday’s peak.

Bitcoin price analysis

Bitcoin is trading at $17,054.93, down by 3.58% since yesterday’s opening. The top cryptocurrency is still in the middle of a short-term bull run, with BTC having gained over 6% from last week’s low of $16,000. However, the rally was short-lived and the current market sentiment is bearish.

Bitcoin is still holding above the MA (200) at $16,812.92.BTC’s price action is showing signs of consolidation, as the asset is trading between $17,000 and $18,000 for the past few days.

Ethereum price analysis

Ethereum is trading at $1,214.42, down by 5.75% since yesterday’s opening. ETH is also in the middle of a short-term bull run, having gained over 10% from last week’s low of $1,080. However, the rally has been short-lived and Ethereum’s price action is now starting to show signs of consolidation. ETH is still holding above the MA (200) at $1,187.63. Altcoins analysis.

Most of the altcoins are in the red today, following Bitcoin’s lead. The worst-performed altcoin is USDN, which is down by 13.79% since yesterday’s opening. The top performer is OKB, which is up by 4.15%.

Following the upward swing to its highest point in a month, the trade price of Bitcoin and other cryptocurrencies have been going down – but what could be causing this movement? Global market turbulences can likely be attributed to statements from the United States Federal Reserve and recent financial data.

After initially benefitting from the Consumer Price Index (CPI) numbers, which showed inflation slowing beyond expectations in November, crypto and stocks flipped bearishly.

This time around, however, there is plenty for crypto investors to worry about — beyond macro, the FTX saga rolls on, with concerns around Binance also lingering.